The SBA has been busy in the last several weeks, as have lenders participating in the Paycheck Protection Program. SBA issued helpful top-line overviews of key points to both First Draw and Second Draw PPP loans. First Draw loans are available to eligible businesses with up to 500 employees, or that otherwise meet SBA size eligibility criteria.

First Draw loans are capped at $10 million, or 2.5X average monthly payroll. Additional guidance was issued on calculating loan amounts and providing documentation to support average monthly payroll costs for First Draw loans. Second Draw loans are capped at $2 million, with some additional restrictions. In addition, while First Draw loans allow for a covered period of 8 weeks or 24 weeks following loan disbursement and some were issued early on with a 5-year repayment requirement on any balances not forgiven, all Second Draw loans have a 24-week covered period and any balances not ultimately forgiven are payable at a rate of 1% over 5 years.

You should carefully consider how you determine the number of employees you list on your application, as it could affect both:

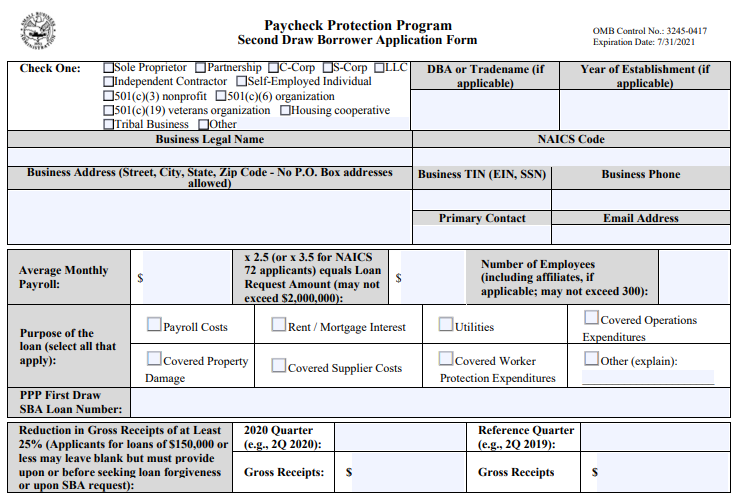

In addition, you must still spend 60% of your PPP loan proceeds on payroll costs to be eligible for forgiveness. For most borrowers, the maximum loan amount of a Second Draw PPP Loan is 2.5x average monthly 2019 or 2020 payroll costs up to $2 million.

For borrowers in the Accommodation and Food Services sector with a NAICS code of 72, the maximum loan amount for a Second Draw PPP Loan is 3.5x average monthly 2019 or 2020 payroll costs up to $2 million. In addition, for businesses in the Accommodation or Food Services sector, your maximum loan amount will be capped at $30,000 X the number of employees listed on your application to account for the $100,000 cap for individual employees. Per SBA guidance issued on January 19, 2021, this higher maximum loan amount only applies if the business activity code reported on your most recent IRS Form 990 Part VIII, adjacent to line 2A begins with 72. The cap continues to be $20,833 per employee on all other loans. If you list a lower count of employees on your Second Draw application than you did on your first, you will not be able to obtain the same loan amount you did for your First Draw loan.

The new Loan Forgiveness and Loan Review IFR issued late the evening of January 19, 2021 notes that for forgiveness, you may use the reference period of February 15, 2019 through June 30, 2019 OR January 1, 2020 through February 29, 2020 for your reference period in determining forgiveness. If you use the same employee count you did on your First Draw application, you may qualify for the same loan amount, however, you must restore your employee count to that level no later than the end of the covered period for spending the loan proceeds to qualify for maximum forgiveness. There are certain other exemptions to restoring your employee count, including being able to evidence your business operations were impacted by a government-mandated shutdown; however, you will need to provide sufficient documentation of both the order and the impact to your operations.

Additionally, if you list your employee count from your First Draw application to achieve the maximum Second Draw loan, and you cannot spend 60% of the Second Draw loan proceeds on payroll expenses during your Second Draw loan’s covered period, you will not be eligible for loan forgiveness. You should consult with your financial advisor to determine the appropriate number to list on your Second Draw application.

Unlike First Draw PPP Loans, the Economic Aid Act provides that the relevant time period for calculating a borrower’s payroll costs for a Second Draw PPP Loan can be either based on 2019 payroll data or 2020 data. Borrowers applying for a Second Draw PPP loan who are not self-employed, sole proprietorships, or independent contractors are also permitted to use the precise 1-year period before the date on which the loan is made to calculate payroll costs if they choose not to use 2019 or 2020.

According to the Second Draw IFR, 2019 or 2020 data can be used at the “borrower’s election”. The loan amount should be the lesser of $2 million or the product obtained by multiplying “the average total monthly payment for payroll costs incurred or paid by the borrower during either 2019 or 2020 (at the borrower’s election)” by 3.5 (if NAICS code – as per filed tax returns – begins with 72) or 2.5 for all other businesses.

Remember, though, that you will be held accountable to restoring your employee count by the end of your Second Draw covered period to the 2019 or 2020 reference period you elect on your forgiveness application, subject to certain exceptions, in order to qualify for maximum forgiveness. Again, we recommend that you consult with your financial advisor to determine the approach you use based upon what is best for your individual business.

Borrowers must certify that at least 60% of the proceeds of their Second Draw loans will still be used for Payroll Expenses in order to be eligible for the loan. This holds true even if a business is under a shutdown order and does not currently have employees on staff. The business must also be in operation at the time of application.

The covered period for spending these loan proceeds (capped at 2.5X average monthly payroll or 3.5X payroll if in the hospitality or restaurant industries with NAICS codes that begin with a 72) is 24 weeks from the date of disbursement. In addition, the business must have no more than 300 employees and must demonstrate a 25% revenue reduction in gross receipts between comparable quarters in 2019 and 2020.

SBA guidance was also issued on January 19, 2021 detailing the documentation required to evidence the drop in revenues, which would appear to require a borrower signature on unfiled tax returns and/or interim financials certifying their accuracy.

It also clarifies that you may only use the 3.5X multiplier to determine loan amount if “your business is in the Accommodation and Food Services sector and the business activity code reported on your most recent IRS Form 990 Part VIII, adjacent to line 2A begins with 72.”

The primary documentation that will be accepted to evidence the decline includes:

- Quarterly financial statements for the entity. If the financial statements are not audited, the Applicant must sign and date the first page of the financial statement and initial all other pages, attesting to their accuracy. If the financial statements do not specifically identify the line item(s) that constitute gross receipts, the Applicant must annotate which line item(s) constitute gross receipts.

- Quarterly or monthly bank statements for the entity showing deposits from the relevant quarters. The Applicant must annotate, if it is not clear, which deposits listed on the bank statement constitute gross receipts (e.g., payments for purchases of goods and services) and which do not (e.g., capital infusions).

- Annual IRS income tax filings of the entity (required if using an annual reference period). If the entity has not yet filed a tax return for 2020, the Applicant must fill out the return forms, compute the relevant gross receipts value, and sign and date the return, attesting that the values that enter into the gross receipts computation are the same values that will be filed on the entity’s tax return.

The amounts required to compute gross receipts varies by the entity tax return type, and the SBA guidance provides specific examples based upon how your income taxes will be filed.

If quarterly financials are used, it is up to the borrower to determine which accrual method to use for calculating gross receipts, however, the same method must be used for both quarters. You should talk to your financial advisor to determine the appropriate method to use on your application. It is possible that your forgiveness amount could be impacted if it appears as though you used one method or another to inflate the overall decline in revenue based on what you report on your annual returns.

SBA issued guidance on January 17, 2021 on how to calculate loan amounts for First Draw loans. In some cases, borrowers are realizing they may have inadvertently miscalculated their First Draw loan amount as they are applying for a Second Draw loans. In such cases, borrowers should be using the correct information to calculate their Second Draw loan amount. In addition to the First Draw guidance, last weekend SBA issued a procedural notice to inform PPP lenders of the appropriate action to take when making a determination as to loan forgiveness amount when the initial loan amount on the PPP Loan Application was incorrect.

The procedural notice provides for two common examples:

In the first example, remember that payroll amounts exceeding $100,000 for individual employees (including owners) were to be excluded from the requested loan amount. In addition, payments made to independent contractors cannot be included in your payroll costs, as 1099 employees are eligible to apply themselves for PPP.

If such an error was made in the employee costs used to calculate your First Draw PPP loan, and it wasn’t a knowing misstatement, this error is corrected by the lender denying forgiveness for the amount of your loan that exceeded the correct maximum loan amount. You would then be responsible to repay the remaining balance at a rate of 1% over the 2- or 5-year repayment period established by the original loan documents. Errors in your calculation on First Draw loans are being detected due to SBA’s automatic data checks against filed tax reports, including employee counts listed on filed 941’s. We have seen applications for Second Draw loan applications be held up for approval by the SBA if the First Draw loan is under review by the SBA due to such a discrepancy.

Other errors include a mismatch of the TIN used on the tax return filing and/or incorrect NAICS codes when compared to filed returns, and it appears there is an automated validation against tax filings and First Draw PPP application data.

Please keep in mind: Under the new program, SBA may take as many as 5 days to complete their review process and SBA Loan Numbers are no longer issued immediately upon submission of an application.

Stay well, and please let us know how we can help with questions you might have on PPP loans!

Previous: Finding Funds in an Emergency Next: SBA Issues “Reminder”