The media has muddied the waters a bit about whether the SBA has opened its portal for First Draw Loans on January 11 and Second Draw loans January 13 for Community Financial Institutions. Rest assured, the portal is not yet reopened for the majority of PPP lenders, as “Community Financial Institutions” are narrowly defined by the SBA. SBA clarified in their release that “shortly following, the PPP will open through March 31, 2021, to all lenders with delegated authority for First and Second Draw PPP loans.” Well, we just learned that SBA is reopening their portal on January 15 for community banks with $1 billion or less in total assets! That means we will be able to begin submitting PPP applications on behalf of ARB customers on Friday! All other lenders will be able to submit PPP applications on Tuesday, January 19.

FAQs and resources for PPP loan applications, and today we began sending out links to ARB clients to begin completing their First and Second Draw PPP loan applications. Please continue to check back for updates at our PPP Resource page.

You can also check out our blog post on what’s changed with the Economic Aid Act, and read on for a discussion of eligible uses for PPP loans, as well as a few new frequently asked questions. As always, we’ll continue to post updates as we receive them, but don’t be shy about telling us if there are any other questions we can help address.

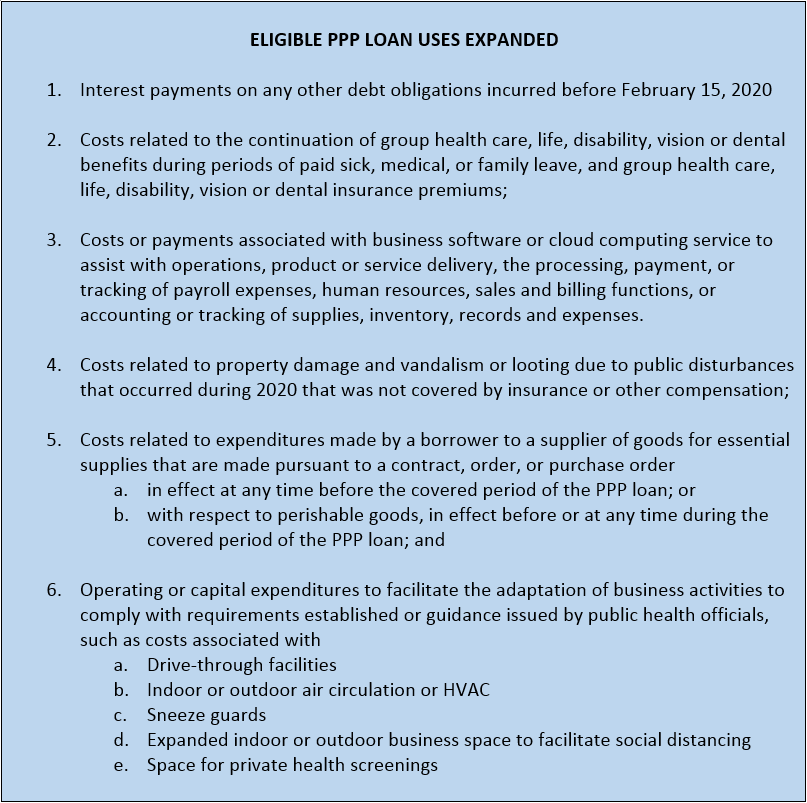

Economic Aid Act Expands the Eligible Uses for PPP Loan Proceeds

Previously, PPP loan proceeds could only be used for:

While 60% of the loan proceeds must still be spent on payroll costs to qualify for maximum forgiveness, the Interim Final Rule on the Paycheck Protection Program expanded the eligible uses of PPP loans to make up the remaining 40%. As before, you still have the option to elect a covered period of 24 weeks so in many cases you will have enough in payroll expense by electing the longer period to avoid having to track other eligible expenses as part of your forgiveness application.

The Interim Final Rule (IFR) provides for some flexibility in calculating the maximum loan amount borrowers are eligible for under the increased calculation for businesses with NAICS codes beginning with 72 (such as restaurants) who have seasonal income or who are new entities that did not exist for the full twelve-month period preceding the Second Draw PPP Loan; however, it also provides clarification on how to determine what NAICS code is used on the application. According to the IFR, you must have had a NAICS code 72 “at the time of disbursement” for your First Draw PPP or on your “most recent filed tax return”.

As defined by section 315 of the Economic Aid Act, a borrower is a seasonal employer if it does not operate for more than 7 months in any calendar year or, during the preceding calendar year, it had gross receipts for any 6 months of that year that were not more than 33.33 percent of the gross receipts for the other 6 months of that year. Under section 336 of the Economic Aid Act, a seasonal employer must determine its maximum loan amount for purposes of the PPP by using the employer’s average total monthly payments for payroll for any 12-week period selected by the seasonal employer beginning February 15, 2019, and ending February 15, 2020.

Consistent with the Economic Aid Act, subsections (f)(3) and (f)(4) of the IFR include tailored calculation methodologies for seasonal businesses, new entities that did not exist for the full twelve-month period preceding the Second Draw PPP Loan, and borrowers assigned a NAICS code beginning with 72 at the time of disbursement. For borrowers assigned a NAICS code beginning with 72 at the time of disbursement, the Economic Aid Act provides that the maximum loan amount is equal to three-and-a-half (3.5) months of payroll costs rather than two- 14 and-a-half (2.5) months.

These subsections further provide that, for a borrower with a NAICS code beginning with 72 that would fall into more than one category listed in subsection (f) (for example, a business with a NAICS code beginning with 72 that is also a seasonal business or is also a new entity), the borrower may calculate its average monthly payroll costs as noted below but may use the 3.5 multiplier applicable to businesses with a NAICS code beginning with 72.

The maximum amount of a Second Draw PPP Loan to a borrower that is a seasonal employer is calculated as the lesser of: (i) the product obtained by multiplying: (A) at the election of the borrower, the average total monthly payments for payroll costs incurred or paid by the borrower for any 12-week period between February 15, 2019 and February 15, 2020; by (B) 2.5 (or, only for a borrower assigned a NAICS code beginning with 72 at the time of disbursement as defined in subsection (f)(10), 3.5); or (ii) $2,000,000.

According to Section (f)(10), for purposes of calculating a borrower’s maximum payroll costs, a borrower may multiply its average monthly payroll costs by 3.5 only if the borrower is in the Accommodation and Food Services sector and has reported a NAICS code beginning with 72 as its business activity code on its most recent IRS income tax return.

We will accept any tax forms, including annual tax forms, or quarterly financial statements or bank statements. Borrowers must certify to a revenue reduction at application. You should consult with your tax advisor on what to report for quarterly gross receipts based on the method you will use to file your taxes. While there are no tax forms for quarterly revenue the final filed financial statements and/or tax returns must be provided to us with the forgiveness application. Any errors in your calculations could reduce your overall forgiveness amount if the SBA selects your loan for review.

Thanks for reading and stay well!

Previous: SBA Issues New Final Interim Rules Next: Finding Funds in an Emergency