True Community Banking

What does True Community Banking mean? It means matching our expertise with yours to find solutions for your unique needs.

* Carmen Garriazo, Belnano Coffee

Industries We Serve¶

Our specialized teams and expert bankers are dedicated to crafting tailored financial solutions for diverse industries. We're committed to your business success, providing robust products and strategies that address the specific needs of your sector.

Small Business¶

Every business is unique, which is why our business banking experts take the time to learn about your company's needs so we can offer the best solutions. We offer accounts and services that give you the maximum amount of flexibility and choice.

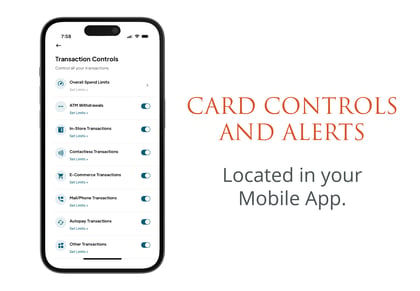

Personal Banking¶

Banking is about more than just checking and savings accounts. As a full-service community bank, we offer all the options you’d expect at a big bank from bankers who know you by name and can help you pick the best products and services to meet your needs.

* Carmen Garriazo, Belnano Coffee