With instant Card Controls through your American Riviera Bank® Mobile Banking App and Mastercard® Zero Liability Protection, using your Debit Card has never been safer.

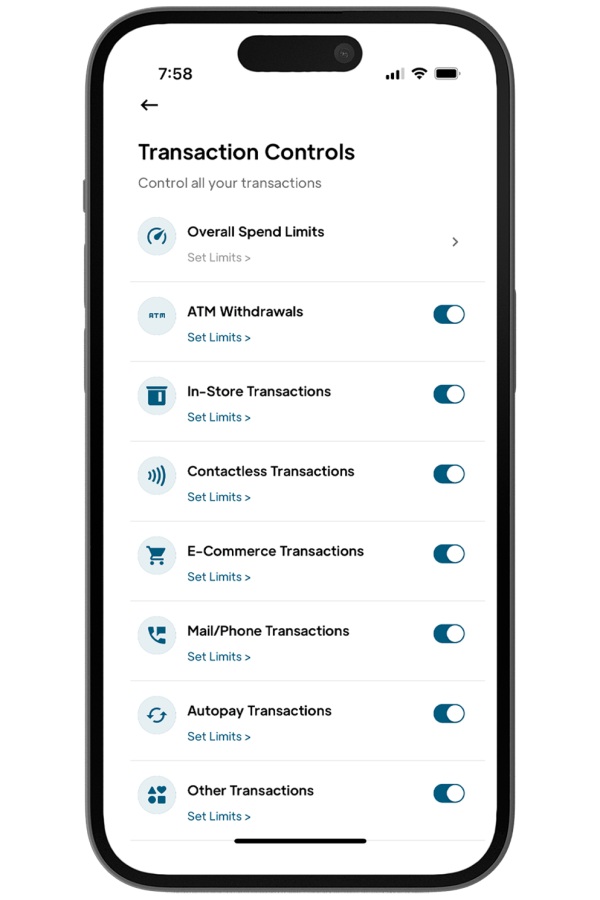

Located within your ARB Mobile Banking App, Card Controls gives you instant control of how and when your card can be used. Can't find your card? Turn it off in the app! Don't want it used for online purchases? Block them with the app!

Set up notifications to be alerted instantly any time your card is used or customize your notifications based on transaction or merchant types, or by amount so you only receive the alerts you want.

Features:

Additional Protection

Your American Riviera Bank® Debit Card also comes with Mastercard® ID Theft Protection to better safeguard you against possible identity theft and bring you security and peace of mind. Enrollment required. Learn more.

Tap the More Settings icon in the upper right-hand corner. Tap Add a new card and follow the instructions.

There is no limit to the number of cards you register.

When a transaction category is disabled, point-of-sale (POS) transactions for that specific type of transaction will be declined. A notification will be pushed from the American Riviera Bank® app with the transaction details.

When a merchant category is disabled, point-of-sale (POS) transactions for that specific type of merchant will be declined. A notification will be pushed from the American Riviera Bank® app with the transaction details.

Region Shield allow you to set up regions by zip code, city or State. Transactions that take place outside those regions will be declined. A notification will be pushed from the American Riviera Bank® app with the transaction details.

You can also set up International Transactions by selecting countries in which transactions will be permitted. Any transactions outside those countries will be declined. A notification will be pushed from the American Riviera Bank® app with the transaction details.

The limits you select will limit the amount you can spend using your debit card for point-of-sale (POS) transactions using the selected card. Any card transaction that exceeds the transaction, daily or monthly limit will be declined and a notification will be sent with the details.

The freeze card feature allows you to lock your card temporarily. All transactions will be declined while the card is in a frozen status except for recurring/auto payments.

No, autopay and recurring transactions will continue when the card is frozen.

Yes, when the card is in a frozen status, you can make changes to other card controls.

Controls and alerts come into effect immediately after you save your preferences.

Yes. Region Shield and International Transactions card controls can be used in conjunction with one another. When Region Shield and International Transactions are enabled, you will only be able to use your card in those regions/countries selected.

When a transaction is declined due to a control that was setup in the app, a push notification is sent. You can view the card control(s) that cause the decline by going to Transaction History. Tap the declined transaction and the control(s) that were evoked during the authorization will be listed near the bottom.

Please note: The transaction could also be declined because of external factors like insufficient funds or fraud monitoring - the app will not display these external factors.

Notifications let you know when certain events occur. You can choose to turn on/off notifications for the following events:

Notifications will be sent as a push notification on your mobile phone. Notifications can also be viewed in-app by clicking on the bell notification icon.

Yes, you can control certain app notifications for transactions, card management and card controls.

Tap the More Settings icon at the top right-hand side of the screen, then tap Notification Settings to manage your preferences.

Archiving a card allows you to hide a card and all related transaction information from the home view while keeping the card controls.

Cards can be archived by clicking the Manage icon under your card image.

No, archiving a card only removes the cards from the home screen view, all controls will remain active.

You may want to archive a card when the card has expired, the card gets reported as lost or stolen or if you no longer want to see the card and related transactions in the Card Suite Lite app but want the card controls to remain active.

Yes. Tap the More Settings icon at the top right-hand side of the screen, then tap Archived Cards to see your archived cards. You can also unarchive the card.

A password is required to login to the mobile app. Additionally, the app does not store personal information on your mobile device and will only ever display the last four digits of your card number. It is not a payment app; it is a management tool for your card.