Updated 2/24/2021

In reality, not much has changed for businesses applying for their first PPP loan. The Consolidated First Draw PPP Interim Final Rule, reminds borrowers that SBA’s affiliation rules (13 CFR 121.301) do not apply to any business entity that is assigned a NAICS code beginning with 72 (Hospitality or food service industry) and that employs not more than a total of 500 employees. This means that if each hotel or restaurant location owned by a parent business is a separate legal business entity and employs not more than 500 employees, each hotel or restaurant location is permitted to apply for a separate PPP loan provided it uses its unique EIN. Second draw loans are also available for eligible businesses who have already used their First Draw. Refer to our FAQs below for additional information.

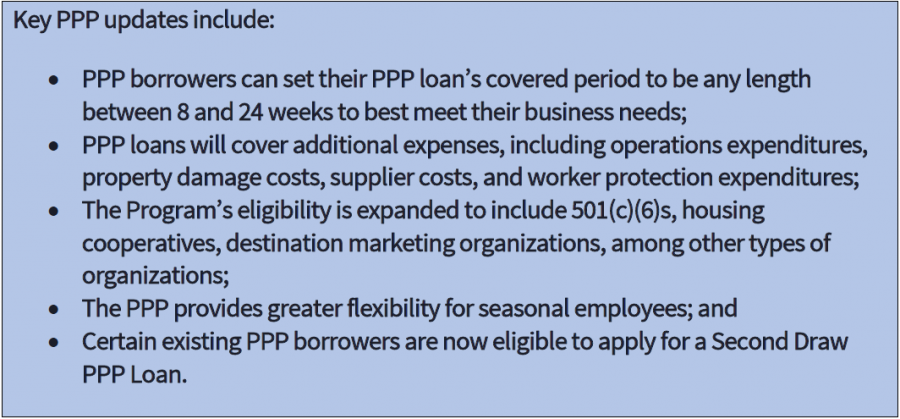

There have been a few changes to eligible businesses, to include certain newspaper outlets and 501(c)6 organizations that were previously excluded under the original PPP loan program, but for the most part the original PPP definition for eligible businesses is the same. Publicly traded companies, companies receiving passive income, and those participating in federally illegal activities continue to be ineligible for PPP loans.

Of note is the fact that the Economic Aid Act required payroll costs to be based upon payroll costs incurred during the 1-year period before the date on which the loan is made. For PPP loans made in 2020, most borrowers used 2019. The First Draw IFR makes it clear that new borrowers can choose either 2019 or 2020 as their base period for calculating payroll costs, thereby ensuring that they are able to obtain funding consistent with existing PPP borrowers.

You must submit documentation sufficient to establish eligibility and to demonstrate the qualifying payroll amount, which may include, as applicable, payroll records, payroll tax filings, Form 1099-MISC, Schedule C or F, income and expenses from a sole proprietorship, or bank records. Please refer to the Borrower Guide that is included with your welcome email to apply for additional details on required documentation.

Refer to the FAQs below for answers to common questions.

Businesses “still in operation” are eligible for a 2nd draw loan in accordance with the program requirements outlined in the Interim Final Rule for Second Draw Loans. Small businesses can apply for a second PPP loan through March 31, 2021, or until funds are depleted, if they fit into the following criteria:

AND

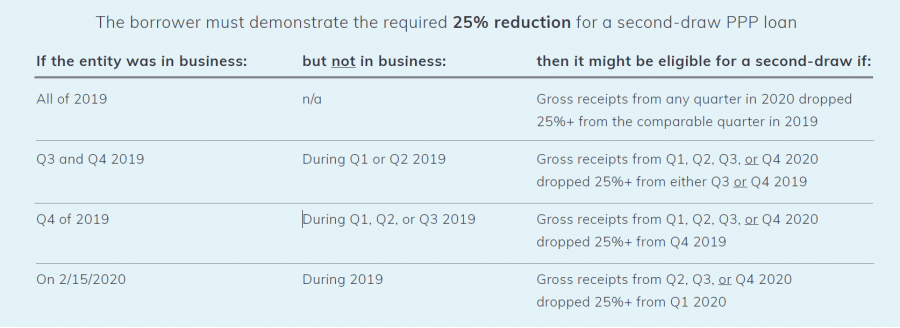

There is a demonstrated 25% revenue reduction in 2020 relative to 2019 in any single quarter.

However, the IFR also notes that Second Draw PPP Loan borrowers who are not self-employed (including sole proprietorships and independent contractors) are also permitted to use the precise 1-year period before the date on which the loan is made to calculate payroll costs if they choose not to use 2019 or 2020 to calculate payroll costs. There are a few modifications to this maximum loan amount calculation, including for seasonal businesses, farmers and ranchers, and new entities that did not exist for the full twelve-month period preceding the Second Draw PPP Loan.

If quarterly financials are used, it is up to the borrower to determine which accrual method to use for calculating gross receipts, however, the same method must be used for both quarters. You should talk to your financial advisor to determine the appropriate method to use on your application. It is possible that your forgiveness amount could be impacted if it appears as though you used one method or another to inflate the overall decline in revenue based on what you report on your annual returns.

To assist those businesses that don’t maintain quarterly filings, the IFR also provides that a borrower that was in operation in all four quarters of 2019 is deemed to have experienced the required revenue reduction if it experienced a reduction in annual receipts of 25 percent or greater in 2020 compared to 2019 and the borrower submits copies of its annual tax forms substantiating the revenue decline. This provision will allow a borrower to provide annual tax return forms to substantiate its revenue reduction.

The IFR defines “gross receipts” consistent with the definition of receipts in 13 C.F.R. 121.104 of SBA’s size regulations. The amounts required to compute gross receipts varies by the entity tax return type, and the SBA guidance provides specific examples based upon how your income taxes will be filed:

Proceeds from first round PPP program are not included in gross receipts.

SBA guidance was also issued on January 19, 2021 detailing the documentation required to evidence the drop in revenues, which would appear to require a borrower signature on unfiled tax returns and/or interim financials certifying their accuracy.

It also clarifies that you may only use the 3.5X multiplier to determine loan amount if “your business is in the Accommodation and Food Services sector and the business activity code reported on your most recent IRS Form 990 Part VIII, adjacent to line 2A begins with 72.”

The primary documentation that will be accepted to evidence the decline includes:

- Quarterly financial statements for the entity. If the financial statements are not audited, the Applicant must sign and date the first page of the financial statement and initial all other pages, attesting to their accuracy. If the financial statements do not specifically identify the line item(s) that constitute gross receipts, the Applicant must annotate which line item(s) constitute gross receipts.

- Quarterly or monthly bank statements for the entity showing deposits from the relevant quarters. The Applicant must annotate, if it is not clear, which deposits listed on the bank statement constitute gross receipts (e.g., payments for purchases of goods and services) and which do not (e.g., capital infusions).

- Annual IRS income tax filings of the entity (required if using an annual reference period). If the entity has not yet filed a tax return for 2020, the Applicant must fill out the return forms, compute the relevant gross receipts value, and sign and date the return, attesting that the values that enter into the gross receipts computation are the same values that will be filed on the entity’s tax return.

You may use either 2020 or 2019 data to calculate your 2nd draw PPP loan; however, we will not require additional documentation to substantiate payroll costs if you

The IFR provides that lenders may request additional documentation to conduct a review of eligibility. In addition, for loans with a principal amount greater than $150,000, you must also submit documentation adequate to establish that you experienced a revenue reduction of 25% or greater in 2020 relative to 2019 as defined above. Such documentation may include relevant tax forms, including annual tax forms, or, if relevant tax forms are not available, quarterly financial statements or bank statements. For loans with a principal amount of $150,000 or less, such documentation is not required at the time you submit your application for a loan, but it must then be submitted on or before the date you apply for loan forgiveness, or at the request of SBA if you haven’t applied for forgiveness.

You should carefully consider how you determine the number of employees you list on your application, as it could affect both:

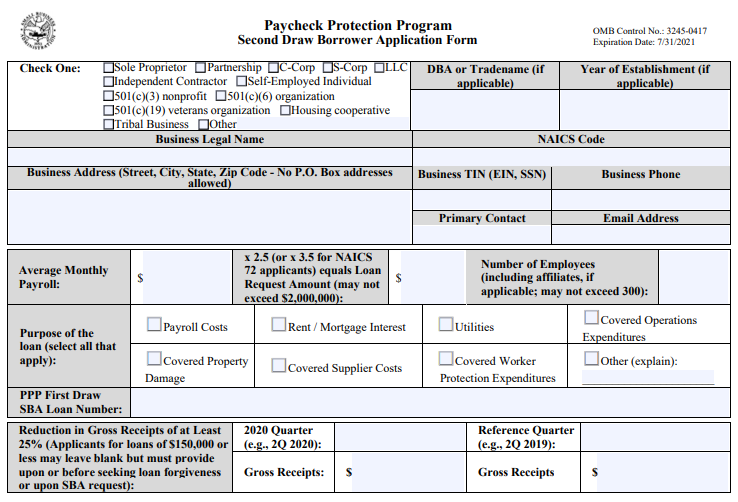

In addition, you must still spend 60% of your PPP loan proceeds on payroll costs to be eligible for forgiveness. For most borrowers, the maximum loan amount of a Second Draw PPP Loan is 2.5x average monthly 2019 or 2020 payroll costs up to $2 million.

For borrowers in the Accommodation and Food Services sector with a NAICS code of 72, the maximum loan amount for a Second Draw PPP Loan is 3.5x average monthly 2019 or 2020 payroll costs up to $2 million. In addition, for businesses in the Accommodation or Food Services sector, your maximum loan amount will be capped at $30,000 X the number of employees listed on your application to account for the $100,000 cap for individual employees. Per SBA guidance issued on January 19, 2021, this higher maximum loan amount only applies if the business activity code reported on your most recent IRS Form 990 Part VIII, adjacent to line 2A begins with 72. The cap continues to be $20,833 per employee on all other loans. If you list a lower count of employees on your Second Draw application than you did on your first, you will not be able to obtain the same loan amount you did for your First Draw loan.

The new Loan Forgiveness and Loan Review IFR issued late the evening of January 19, 2021 notes that for forgiveness, you may use the reference period of February 15, 2019 through June 30, 2019 OR January 1, 2020 through February 29, 2020 for your reference period in determining forgiveness. If you use the same employee count you did on your First Draw application, you may qualify for the same loan amount, however, you must restore your employee count to that level no later than the end of the covered period for spending the loan proceeds to qualify for maximum forgiveness. There are certain other exemptions to restoring your employee count, including being able to evidence your business operations were impacted by a government-mandated shutdown; however, you will need to provide sufficient documentation of both the order and the impact to your operations.

Additionally, if you list your employee count from your First Draw application to achieve the maximum Second Draw loan, and you cannot spend 60% of the Second Draw loan proceeds on payroll expenses during your Second Draw loan’s covered period, you will not be eligible for loan forgiveness. You should consult with your financial advisor to determine the appropriate number to list on your Second Draw application.

Unlike First Draw PPP Loans, the Economic Aid Act provides that the relevant time period for calculating a borrower’s payroll costs for a Second Draw PPP Loan can be either based on 2019 payroll data or 2020 data. Borrowers applying for a Second Draw PPP loan who are not self-employed, sole proprietorships, or independent contractors are also permitted to use the precise 1-year period before the date on which the loan is made to calculate payroll costs if they choose not to use 2019 or 2020.

According to the Second Draw IFR, 2019 or 2020 data can be used at the “borrower’s election”. The loan amount should be the lesser of $2 million or the product obtained by multiplying “the average total monthly payment for payroll costs incurred or paid by the borrower during either 2019 or 2020 (at the borrower’s election)” by 3.5 (if NAICS code – as per filed tax returns – begins with 72) or 2.5 for all other businesses.

Remember, though, that you will be held accountable to restoring your employee count by the end of your Second Draw covered period to the 2019 or 2020 reference period you elect on your forgiveness application, subject to certain exceptions, in order to qualify for maximum forgiveness. Again, we recommend that you consult with your financial advisor to determine the approach you use based upon what is best for your individual business.

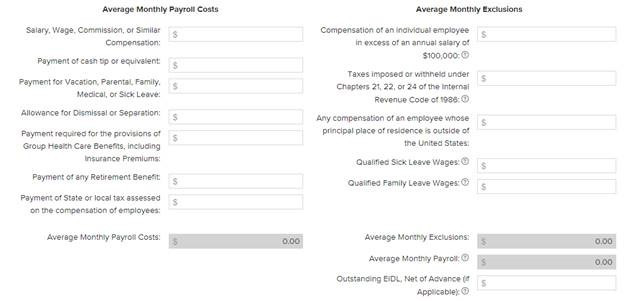

The original definition for determining the maximum loan amount has not changed, although the definition of eligible expenses for forgiveness has been expanded slightly under the Paycheck Protection Program Interim Final Rule amended by the Economic Aid Act. Loan amounts will be determined based upon. Payroll costs for determining loan amount continue to include

The employer’s share of Federal employment taxes, and income taxes required to be withheld from employees continues to be expressly excluded from the definition of payroll costs. Note that the employee-paid portion of the Federal taxes is already included in gross salary/wages.

ARB clients who have already received a PPP loan should be able to rely on the documentation submitted with their first draw loan. New PPP borrowers must submit documentation sufficient to establish eligibility and to demonstrate the qualifying payroll amount, which may include, as applicable, payroll records, payroll tax filings, Form 1099-MISC, Schedule C or F, income and expenses from a sole proprietorship, and bank records.

You will be required to provide your Form 941 (or other tax forms containing similar information) and state quarterly wage unemployment insurance tax reporting forms from each quarter in 2019 or 2020 (whichever you use to calculate loan amount), or equivalent payroll processor records, along with evidence of any retirement or health contributions paid. A payroll statement or similar documentation from the pay period that covered February 15, 2020 must be provided to establish you were in operation at that time.

“Individuals with self-employment income who file a Schedule C or F are capped by the amount of their owner compensation replacement, calculated based on 2019 net profit (8/52 of 2019 profit) of up to $15,385 for an 8-week covered period or 2.5 months’ worth (2.5/12) of 2019 net profit (up to $20,833) for a 24-week covered period per owner in total across all businesses”.

No additional forgiveness is provided for retirement or health insurance contributions for self-employed individuals, including Schedule C filers and general partners, as such expenses are paid out of their net self-employment income.

There have been a few changes to eligible businesses as a result of the Economic Aid Act, to include certain newspaper outlets and 501(c)6 organizations that were previously excluded under the original PPP loan program, but for the most part the original PPP definition for eligible businesses is the same. Publicly traded companies, companies receiving passive income, and those participating in federally illegal activities continue to be ineligible for PPP loans.

Note that there may be other causes for ineligibility. An American Riviera Bank team member will be reviewing each initially submitted application to review for eligibility under all criteria.

American Riviera Bank knows and cares about our customers.