Filter on: Idea Vault Regional Pulse News & Press Releases Webinar Clear Filter

(American Riviera Bank) - Scams and fraudulent activities have become increasingly prevalent in today's digital age. One particularly insidious type of scam is the recovery scam, where fraudsters target individuals who have already fallen victim to a previous scam. These scammers pose as helpful in…

Continue Reading

(American Riviera Bank) - Artificial Intelligence has revolutionized various aspects of our lives in the information age, including finance. However, as advancements continue, so do the risks. One emerging and concerning threat is the utilization of artificial intelligence (AI) in financial fraud.…

Continue Reading

(American Riviera Bank) - As the holiday season approaches, American Riviera Bank is gearing up for a heartwarming season of giving with a series of initiatives aimed at making a difference in our local community. Embracing this spirit of giving, the Bank is actively participating in various progra…

Continue Reading

(American Riviera Bank) - The 2023 Central Coast Economic Forecast event in San Luis Obispo, CA, was a resounding success, drawing in more than 500 community leaders eager to gain valuable insights and projections from industry experts.

Continue Reading

(American Riviera Bank) - In the world of financial fraud, a disturbing new trend has emerged, leaving victims both emotionally shattered and financially devastated. “Pig butchering” scams are a variation of classic romance or investment scams and tend to target the older population who have amasse…

Continue Reading

(American Riviera Bank) - ZooLights at the Santa Barbara Zoo is almost here! Check out a sneak peak at this year's ZooLights and don't forget to buy your tickets!

Continue Reading

(American Riviera Bank) - Every day, thousands of people fall victim to fraudulent emails, texts and calls from scammers pretending to be their bank. And in this time of expanded use of online and mobile banking, the problem is only growing worse. In fact, the Federal Trade Commission’s report on…

Continue Reading

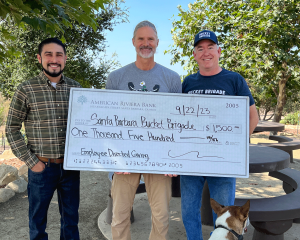

(American Riviera Bank) - Every year, our employees nominate local non-profits that are meaningful to them to receive sponsorships above and beyond our annual corporate giving program. This year our theme is…The Environment!

Continue Reading

(American Riviera Bank) - One of the primary objectives of the State of the County event was to provide the business community with a deeper understanding of the critical issues currently under consideration by local government officials.

Continue Reading

(Laurel Sykes) - Here on the Central Coast of California, the tech industry is booming! What does this mean for residents of the Central Coast? With new funding by both private and public investment partners, Vandenberg Airforce Base is now a regional hub for commercial and military space missions.

Continue Reading