While the need has certainly been no less urgent as small businesses continue to battle stay-at-home orders and local orders for modified operations in accordance with state mandates, the speed at which this latest appropriation of Paycheck Protection Program (PPP) loan funding is certainly slower than what we experienced in the first round in 2020.

The SBA issued a press release on January 26, 2021 noting that, during this newest round, they have approved roughly 400,000 loans totaling over $35 billion of the total $284 billion authorized by the Economic Aid Act.

The reason? SBA has built a significant number of integrations with the IRS, state licensing information, and other data sources such as Dun & Bradstreet to validate the eligibility of a First Draw loan before they will issue approval for a Second Draw loan.

As we discussed previously, errors made in a borrower’s First Draw loan are impacting the approval of a Second Draw loan for the same borrower. SBA places a hold code in their platform when they have information indicating the Borrower may have been ineligible for:

Other issues have been noted when SBA compares application data to public data sources to validate the existence or identity of the business. On January 26, 2021, SBA held a webinar for participating lenders on the “Hold Codes” that lenders were receiving on the SBA platform when submitting Second Draw loan applications for borrowers. The presentation materials reminded lenders of a term covered in the Second Draw IFR, called “Unresolved Borrower”.

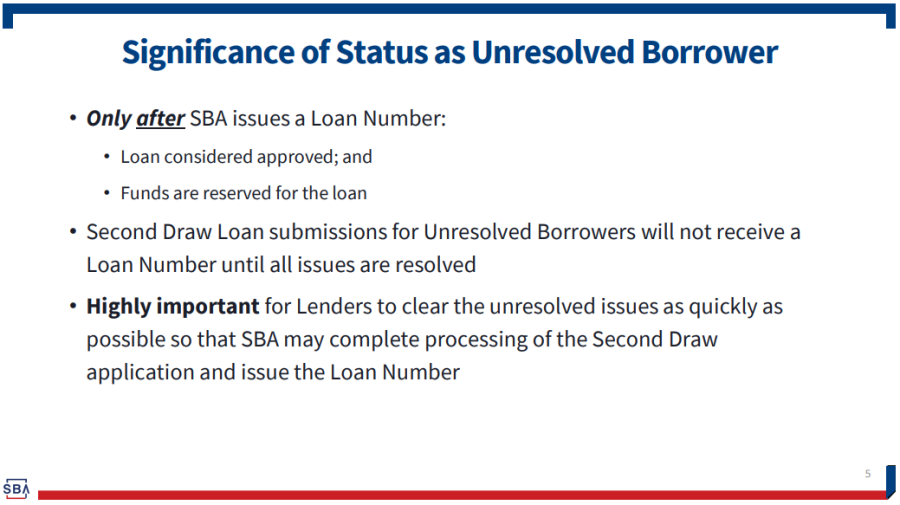

According to the presentation materials, an Unresolved Borrower is a borrower with a hold code on their First Draw PPP Loan.

Having a hold on a borrower’s First Draw loan is significant, as Unresolved Borrowers will not receive an SBA Loan Number reserving funds for a Second Draw loan until all issues are resolved.

SBA also issued a Procedural Notice specifying the process for lenders, and a Documentation List for resolving errors (as of January 26, 2021). To address these hold codes, lenders must provide the Second Draw Application SBA Form 2483-SD and, are not required but strongly encouraged, to submit the borrower’s First Draw Application SBA Form 2483. Lenders must also provide supporting documentation to clear the issue noted. When SBA determines that all issues are resolved, the Second Draw Loan application will be automatically submitted into the next stage of processing. Unfortunately, if the borrower agrees the issue cannot be resolved, the lender must withdraw the Second Draw Loan application.

Below, we cover documentation required to clear the most common errors we are seeing for our own applicants.

We’re seeing errors where the entity/individual name of a borrower or principals, as entered into the SBA platform, appears to be inaccurate when compared to the TIN listed on the application because it does not match with data records used by SBA. In most cases, our borrower-supplied TIN is correct, but we have had to provide proof linking borrower and principal names to TIN (EIN/SSN) to clear the error. The proof we have had to provide includes:

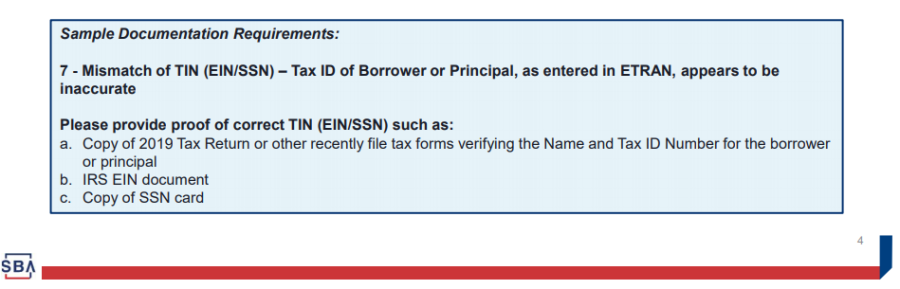

We are also seeing errors where the Tax ID of Borrower or Principal, as entered, appears to be inaccurate. SBA provides that the EIN document may be required to clear the error.

There is also a catch all for a “data mismatch” where the identifying information provided for either the business or the principals cannot be verified or is found to be associated with a different entity or individual in public records. Proof must be provided linking borrower and principal’s names to TIN (EIN/SSN) such as:

In some cases the SBA is questioning the number of employees provided on applications when compared to tax filings. Proof of employee count and size eligibility for the First Draw PPP Loan will be required to clear the hold, such as:

Per SBA, concerns and entities are affiliates of each other when one controls or has the “power to control the other, or a third party or parties controls or has the power to control both”. Affiliates can be determined by common ownership, where an individual, concern, or entity owns or has the power to control more than 50 percent of the concerns’ voting equity. If no individual, concern, or entity is found to control, SBA will deem the Board of Directors or President or Chief Executive Officer (CEO) (or other officers, managing members, or partners who control the management of the concern) to be in control of the concern. There are three other tests for determining affiliation, including common management. It is critical that borrowers consult with legal counsel to provide documentation as to whether the affiliation exists in order to clear this error.

If the borrower appears to have affiliates when compared to public records, the combination of the borrower plus its affiliates could exceed SBA size standards for a Second Draw loan, which is generally no more than 300 employees. Should that number exceed 300 in aggregate, the borrower will be required to prove that they are:

Some additional errors you may be experiencing if the appropriate due diligence was not conducted when the First Draw PPP loan was originated include loans made to businesses that were not in operation as of February 15, 2020, or where the business is no longer active according to Secretary of State filings or public records.

To be considered eligible for PPP, the business must have been in operation on or before February 15, 2020. There is an edit check against public records that indicates that the borrower may have either come into existence after February 15, 2020 or business activity prior to February 15, 2020 was not detected. Proof will be required to determine otherwise that the borrower was in operation as of February 15, 2020 AND at the time of the application such as:

At ARB, we ran eligibility reviews and collected legal documentation to support the existence of businesses as part of the First Draw application process; however, many PPP lenders were new to SBA lending and may not have followed standard due diligence practices. If the business is not a currently “active business” according to Secretary of State filings or public records, it could result in a potential eligibility issue. The borrower will need to provide proof that it was in operation as of February 15, 2020 AND at the time of the application for the First Draw PPP Loan such as:

If the address provided for the loan to the SBA is currently vacant, the borrower will need to provide proof either that:

In the guidance, SBA encourages lenders to work with borrowers to resolve issues with First Draw loans to facilitate approval of their Second Draw applications. As we saw in Round 1 of PPP, community banks are likely to be more responsive to assisting borrowers to get their PPP applications approved than larger or online lenders. In fact, as of second quarter 2020, community banks held 31 percent of PPP loans, with more than four out of five community banks (82 percent) participating in the program according to the FDIC’s community banking report issued December 2020.

We hope that this post helps identify documentation that may be requested to clear holds on applications to facilitate faster approval of Second Draw Loans. We know how critical these funds are for many of our local small businesses, and remind you that we’re here to help! Continue to check back to our blog posts and PPP resource page for the latest information. Stay well!

Previous: SBA Issues “Reminder” Next: Cost vs. Quality