In honor of World Elder Abuse Awareness Month, we wanted to take the opportunity to educate clients on how to recognize and prevent elder financial abuse. Local bankers are in a unique position to recognize red flags commonly associated with fraud in our communities. At ARB, we believe that increasing awareness is the best way to prevent elder financial abuse.

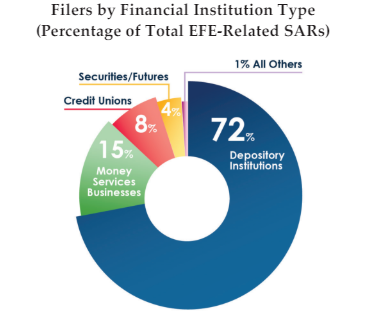

A recent report issued by FinCEN, a bureau of the Department of the Treasury, in April 2024 noted over 155,000 suspicious activity reports tied to “Elder Financial Exploitation” (EFE) were filed by financial institutions, totaling roughly $27 billion in suspicious activity since the issuance of their advisory in June 2022 through June 2023. Banks filed 72 percent of the total EFE-related BSA reports received in the review period.

For the first time, the data showed that elder financial exploitation through scams were reported more often than through theft. FinCEN notes that 80% of reports were for elder scams, with a much higher average dollar amount at around $130,000, versus elder theft, which was under $100,000. Checks and wires were the most frequent methods of transmitting scam funds.

According to the Department of Justice, the Federal Trade Commission, and FinCEN’s advisory, elder financial exploitation is the illegal or improper use of an older adult's funds, property, or assets. Elder scams involve the transfer of money to a stranger imposter for a promised benefit or good that the older adult did not receive, while elder theft involves the theft of an older adult's assets, funds or income by a trusted person.

Financial institutions identified tech support scams and romance scams as the most frequent type of scam, with some level of combined scam types. For example, a pig butchering case could involve a tech support or romance scam blended with a refund scam. There were also reports of real estate and timeshare scams combined with government impersonations, as well as loved one emergency scam that also involved government impersonation. It’s become so prevalent that the FTC has launched a new campaign highlighting these imposter scams. In addition, this year on World Elder Abuse Awareness Day celebrated annually on June 15, the Department of Justice’s Elder Justice Initiative’s focus was on bringing awareness to the federal government impersonation scams targeting older adults.

Red Flags for Scams

Remember, legitimate government agencies typically do not initiate contact with individuals via unsolicited phone calls, emails, or text messages. They also do not demand immediate payment or sensitive personal information over the phone. The FBI also provides a list of common red flags. Here are some tips when you answer “yes” to any of the following questions.

Recovering from a Scam

If you or a loved one has fallen prey to a scam, you are not alone. In fact, the FBI reported Californians lost roughly $2.1 billion. California was reported to have had both the highest number of victims and the highest dollar amount lost in 2023. The best chance of recovering funds is by reporting immediately. According to Tara McGrath, U.S. Attorney of California's Southern District, if you think you’re a victim it’s important to report within 12 hours of sending funds to a fraudster to allow them to potentially freeze the suspect account. Beyond that time, it’s still important to report the scam because the information may help law enforcement.

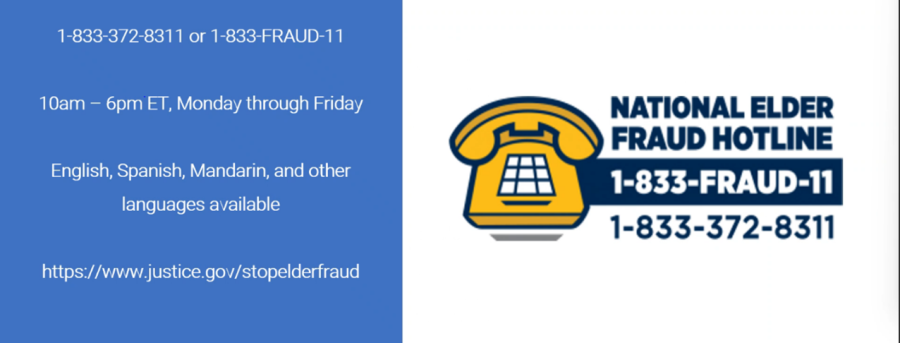

The Department of Justice, Office for Victims of Crime, offers a free hotline that can assist in reporting fraud against anyone age 60 or older. You can also register with the AARP peer support group at https://www.aarp.org/money/scams-fraud/voa-rest-program/.

You can also reach out directly to report fraud with the FTC and FBI:

If the scam involves sending or receiving checks or cash through the mail, you can also file with the US Postal Inspection Service. Submit your report to USPIS at: Report homepage, U.S. Postal Investigation Service, https://www.uspis.gov/report.

Other Helpful Links