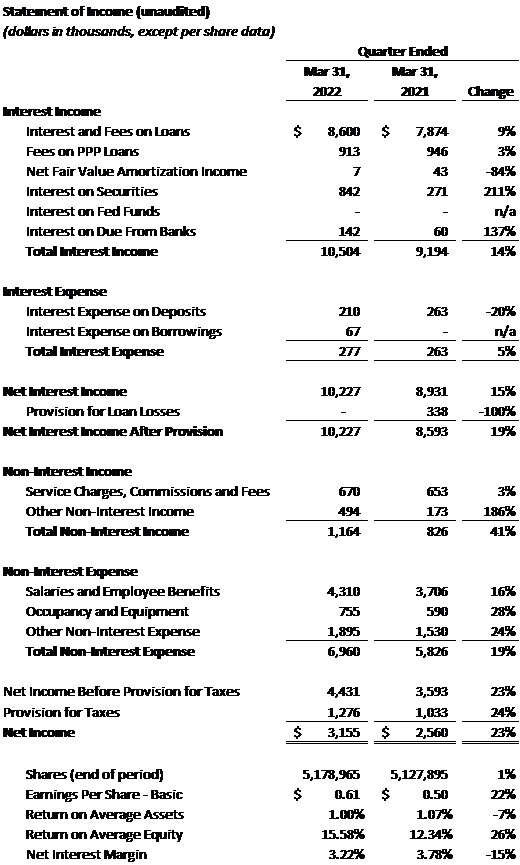

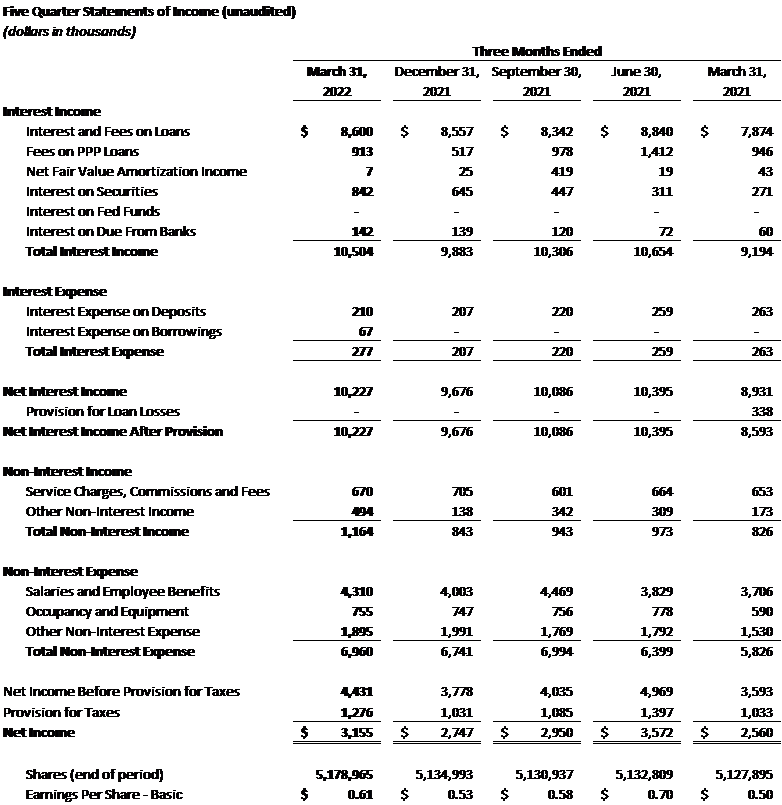

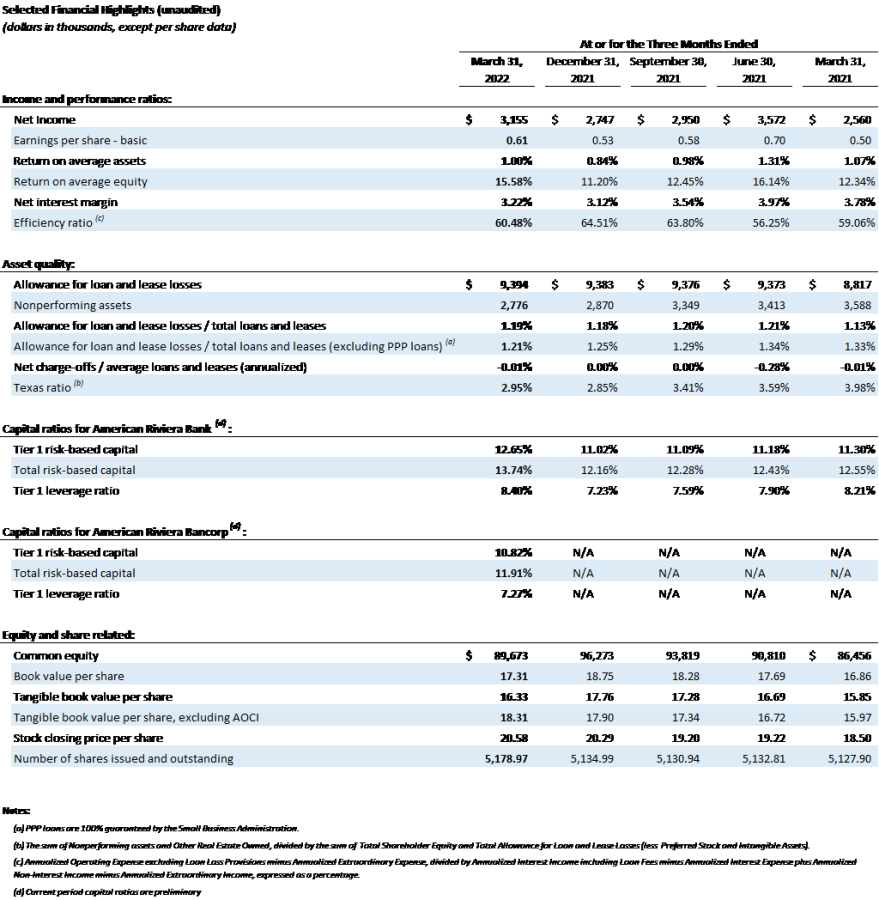

Santa Barbara, California (April 22, 2022) – American Riviera Bancorp (“Company”) (OTCQX: ARBV), holding company of American Riviera Bank (“Bank”), announced today unaudited net income of $3.2 million ($0.61 per share) for the three months ended March 31, 2022. This represents a 23% increase in net income from the $2.6 million ($0.50 per share) earned in the same reporting period in the prior year.

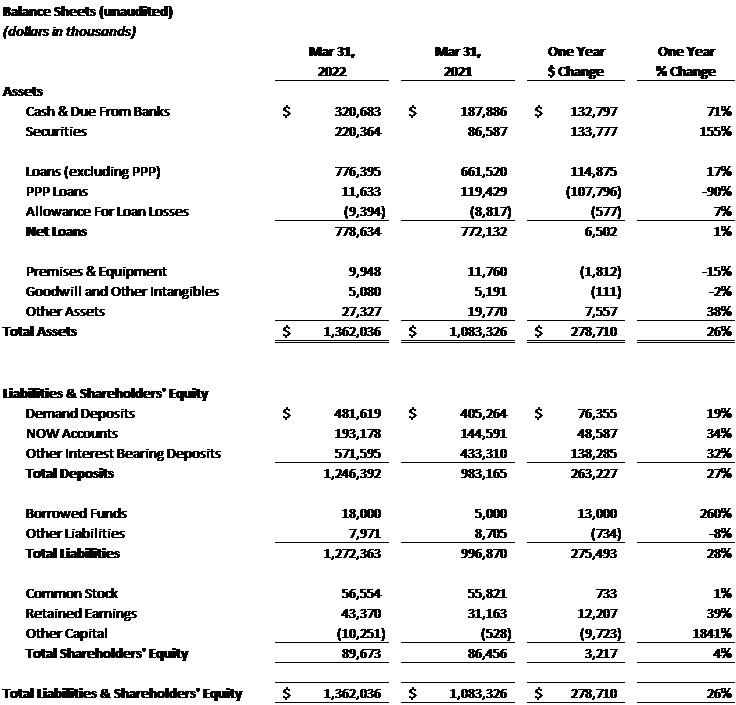

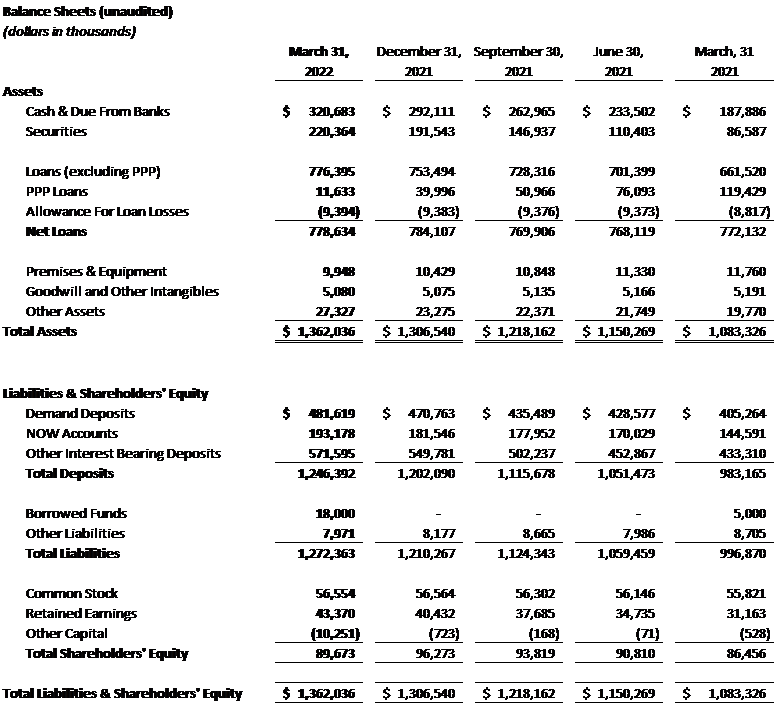

Core loans, excluding SBA PPP loans, have grown 17% or $114.9 million over the last year since March 31, 2021. Core loans have grown 3% or $22.9 million in the last quarter since December 31, 2021. PPP loan forgiveness has been efficiently handled for our small business clients, and only $11.6 million of these 1.00% interest rate loans remained outstanding at March 31, 2022. In the last year, the Bank originated higher-yielding core loans at a volume which exceeded PPP forgiveness and repayments. The Bank maintained strong credit quality with no other real estate owned, no loans 90 days or more past due, and only $2.8 million or 0.36% of total loans excluding PPP on non-accrual status, which are well supported by collateral.

The Bank continues to experience tremendous deposit growth with a 27% or $263.2 million increase in total deposits over the last year since March 31, 2021. Non-interest-bearing demand deposits increased 19% or $76.4 million over the last year. Deposit inflows from our clients have been the driving factor in the total assets of the Company increasing 26% or $278.7 million since March 31, 2021 to a total of $1.4 billion at March 31, 2022.

Jeff DeVine, President and Chief Executive Officer noted, “2022 is off to a great start! The formation of American Riviera Bancorp this quarter and its issuance of $18.0 million of 3.75% fixed to floating rate subordinated notes will bolster capital ratios at the Bank level and support our continued growth. SBA PPP loans have been replaced by higher-yielding core loans, and our sizeable balance sheet liquidity will generate increased interest income in a rising rate environment.”

As of March 31, 2022, the Company and Bank continue to be well capitalized with Tier 1 Capital ratios of 11% and 13%, respectively. The tangible book value per share of American Riviera Bancorp common stock is $16.33 at March 31, 2022.

Statements concerning future performance, developments or events concerning expectations for growth and market forecasts, and any other guidance on future periods, constitute forward looking statements that are subject to a number of risks and uncertainties. Actual results may differ materially from stated expectations. Specific factors include, but are not limited to, effects of interest rate changes, ability to control costs and expenses, impact of consolidation in the banking industry, financial policies of the US government, and general economic conditions.