Filter on: Idea Vault Regional Pulse News & Press Releases Webinar Clear Filter

(Paul Abramson) - At American Riviera Bank, Data Privacy Day is more than a symbolic date on the calendar—it’s an annual reminder of something we live by every day: your financial data belongs to you, not to marketers, data brokers, or hidden third parties. Today, people are paying closer attention…

Continue Reading

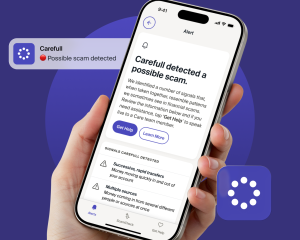

(Rechelle Ringer) - At American Riviera Bank, we’re always looking for ways to help you stay financially safe, confident, and in control. That’s why we’re excited to share a new resource available to all Carefull users—the Carefull Companion App. This mobile app is designed to make financial safety…

Continue Reading

(Robert Orca) - A new year is the perfect time to reset, reorganize, and set intentions. Just like tidying up your home brings peace of mind, organizing and understanding your finances can help you start the year on solid footing. At American Riviera Bank, we’re here to make that easier with free…

Continue Reading

(Laurel Sykes) - Acquiring a business is one of the most significant decisions an entrepreneur or company can make. Whether you’re expanding into a new market, purchasing a competitor, or stepping into business ownership for the first time, acquisitions require careful planning, financial clarity,…

Continue Reading

(Jason Wilson) - In today’s ever-changing economic landscape, business owners face unprecedented challenges that demand both agility and foresight. At American Riviera Bank, we understand that your business isn’t just a source of income—it’s your passion, your legacy, and your contribution to our…

Continue Reading

(Laurel Sykes) - Introduction The holiday shopping season is a time of “big deals”, increased spending, and last-minute purchases. For many, black Friday marks the beginning of the holiday shopping season to take advantage of special deals. Cyber Monday is also a time of increased online purchasing…

Continue Reading

(Annette Jorgensen) - After 35 years in commercial lending, Annette Jorgensen has witnessed a surge in business transitions with acquisition and stock buyout inquiries on the rise in 2025. As Vice President of SBA Business Development at American Riviera Bank, she has the expertise to identify one…

Continue Reading

(Laurel Sykes) - Summary Cyber-enabled scams are rising fast, with $13.7 billion in losses reported in 2024—driven by impersonation, business email compromise, and investment fraud.Instant payment platforms like Zelle and Cash App are frequently exploited by scammers due to their speed and lack of…

Continue Reading

(Paul Abramson) - Summary Phishing and impersonation attacks surged over the past year, with scammers using malicious emails, compromised profiles, and spoofed messages to steal credentials, deploy malware, and redirect funds.Scammers are targeting financial workflows, with rising cases of payroll…

Continue Reading

(Robert Orca) - Summary Scams are evolving fast, with deepfakes, phishing messages, and other AI-driven scams leading to billions in estimated losses. Social media and personal data are key tools for scammers—tighten your privacy settings and stay alert. Sharing emerging scam tactics with family an…

Continue Reading