You may have heard that the Biden administration mandated certain reforms to the PPP eligibility rules. The administration also pushed for a 2-week window where only small businesses with 20 or less employees will be approved by the SBA through March 9, 2021. In response to the mandate, the SBA released its new interim final rule (IFR) and new application forms implementing Paycheck Protection Program changes for sole proprietors and other borrowers that file IRS Form 1040, Schedule C.

They have also updated their Frequently Asked Questions to include new provisions authorized by the Economic Aid Act, which was passed into law earlier this year.

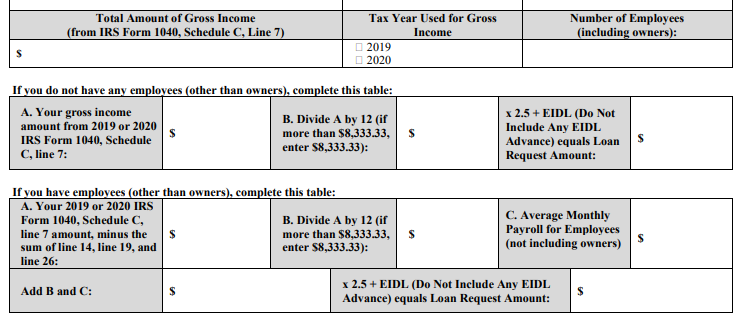

As a result of this change, Schedule C borrowers with no employees may use their PPP proceeds to cover owner compensation (if net profit is used) or proprietor expenses (business expenses plus owner compensation if gross income used).

The higher loan amounts for Schedule C borrowers apply to applications filed after the rule’s effective date which was March 3,, 2021. Loan amounts cannot be increased once the loan is disbursed to the borrower. This presents a bit of a curve ball for sole proprietors, independent contractors and self-employed individuals who have already been approved by the SBA for PPP loans as those loan amounts cannot be increased. Instead, the SBA indicates that these loans must be “canceled” with the SBA before the businesses can reapply for the increased loan amount. Loans that were funded in January were likely already reported to the SBA on what is known as the “1502 report”. Once a loan has been reported to the SBA on the 1502, they cannot take advantage of the new rules.

In cases where the PPP loan has already been funded, the borrower must first pay off the original Round 3 PPP loan, and then work with their lender to apply using the new PPP loan application form.

As the SBA’s system includes data validation checks that will prevent a business from applying for a second First Draw or Second Draw PPP loan, it is possible that they may have to wait several days before the lender can submit their revised PPP loan application to ensure against the automated decline criteria within the SBA system. This may pose an issue if not resolved soon, as the Round 3 PPP appropriation of funds expires on March 31, 2021.

Key considerations businesses who have already been approved for PPP loans should consider when deciding whether it makes sense to take advantage of the new rules include:

As always, American Riviera Bank is here to help. Check out our FAQs as they are being updated with new recent guidance, or send an e-mail to our PPP Support team at [email protected] to get on the list for the new application when it becomes available.

Thanks for reading, and stay well!

Previous: Reducing Your Food Bill Next: