Additional guidance is necessary before we can begin processing PPP loan forgiveness applications as the May 15, 2020 SBA PPP Loan Forgiveness Application must undergo revisions to comply with the new Act. The Small Business Administration (“SBA”) issued a Statement on June 8, 2020, indicating that the Application would be revised “promptly” but provided no estimate for when it would be available.

The Statement also notes that the new rules will confirm that the last day to be approved for a PPP loan remains June 30, 2020.

Arguably the most significant change is that the new Act lowers the threshold for the portion of the PPP Loan proceeds that must be spent on payroll costs from 75% to 60% and extends the “covered period” for using the loan proceeds from 8 weeks to 24 weeks following the date the loan was funded. Previously, payments of principal and interest on existing PPP loans were deferred for a period of six months, meaning that borrowers would not be responsible to make payments on PPP loans until they had a sufficient opportunity to apply for and receive loan forgiveness. The new Act extends the deferral period. If a borrower does not apply for loan forgiveness within 10 months after the end of the covered period, the payment deferral period is extended to 10 months after the last day of the covered period.

Borrowers who have received loans before June 5, 2020, and used their loan proceeds in accordance with previous guidance may continue to elect to be evaluated under the 8-week covered period after PPP loan funding. The prior Interim Final Rule issued on May 22, 2020, provided for an “alternative covered period” for borrowers with bi-weekly or more frequent payroll, beginning on the day of the first payroll following the date the loan was funded.

This is helpful for PPP loan recipients who have been able to reopen for business and who wish to apply for loan forgiveness now, rather than waiting. It appears as though you may apply for loan forgiveness now, based upon your ability to use the loan proceeds and restore employment, salary and wages by June 30, 2020, or you must then wait until after December 31, 2020. It is unclear whether you will be able to apply for loan forgiveness sooner than December 31 if you are unable to restore employment by the original June 30 date. Additional guidance is necessary.

The statement issued by SBA and Treasury on June 8, 2020, further clarified that a Borrower will continue to be eligible for partial loan forgiveness, subject to at least 60 percent of the loan forgiveness amount having been used for payroll costs.

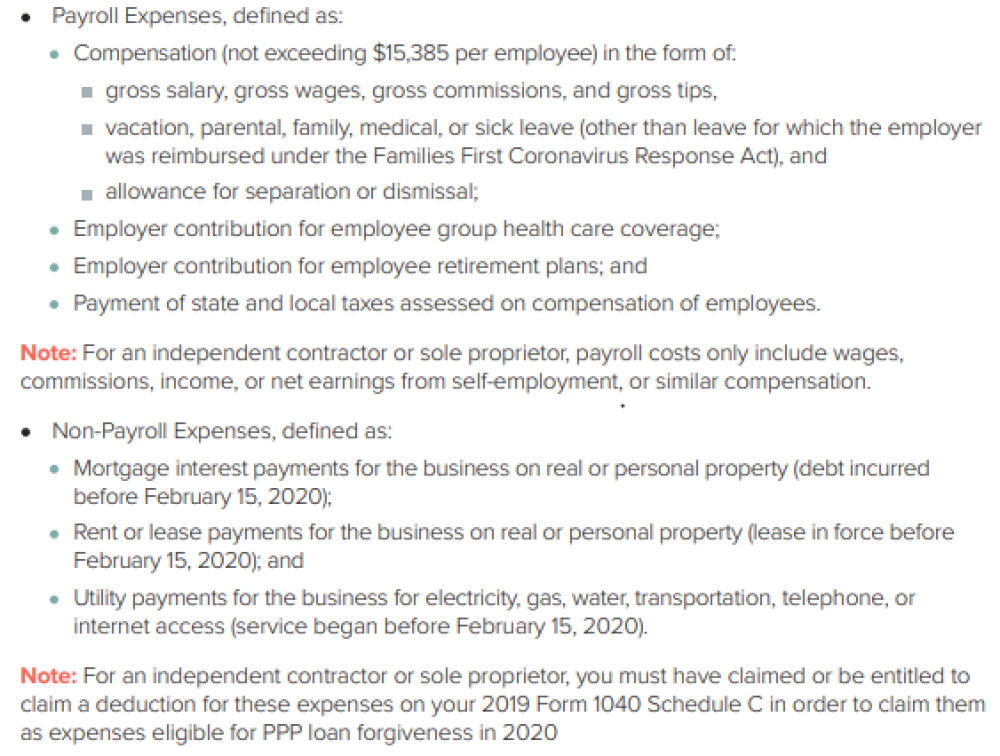

There has been no change to what constitutes “eligible expenses”. Loan forgiveness will be reduced if borrowers spend the loan proceeds on expenses other than payroll costs, mortgage interest payments, rent or lease payments, and utility payments. You should continue to collect documentation to support your use of the PPP loan proceeds to ensure the loan is forgiven. Any balance remaining after loan forgiveness is subject to repayment over 2 years at a 1% interest rate (5 years for loans made after June 5, 2020).

The prior Interim Final Rule issued on May 22, 2020, also provided an exception for any FTE reductions if either of the following occurred:

In addition, there was previously a “Safe Harbor” (and therefore no reduction in the forgivable loan amount) for borrowers who reduced their FTEs during the period beginning on February 15 and ending on April 26, 2020, but who by no later than June 30 restored the FTEs to pre-pandemic levels (as of February 15, 2020). That period has been extended under the new Act to December 31, 2020 for borrowers who are unable to restore to such levels prior to June 30, 2020.

The new Act appears to provide a new requirement for extending the period to rehire whereby the Borrower, in good faith, is able to document one of the following two scenarios outlined below.

Or

“This applies to the maintenance of standards issued during the period of March 1, 2020–December 31, 2020, related to social distancing, sanitation, or any other worker- or customer-safety requirement resulting from the COVID-19 pandemic.”

Obviously these new provisions create inconsistencies in prior guidance and a number of questions remain unanswered. SBA is expected to issue new Frequently Asked Questions (“FAQs”) and interim final rules to implement the provisions of the PPP Flexibility Act in the coming weeks. In the meantime, we recommend you continue to collect documentation to evidence your use of PPP loan proceeds to ensure maximum forgiveness. Please see the Paycheck Protection Program (PPP) [Products № 540] on our website for additional information on required documentation, and stay tuned for additional updates on the PPP loan program. Stay well!

Previous: Why Your Credit Score Matters Next: World Elder Abuse Awareness Day