Small businesses are crucial to our local economy, offering unique goods and services to our area. At American Riviera Bank, we understand small businesses' vital role in our local economy. In this blog, we breakdown loan types and how partnering with a preferred lender and industry expert can help your business grow.

Recent findings from J.D. Power's 2024 Small Business Banking Satisfaction Survey highlight a significant trend: small business owners are increasingly turning to their local banks for support, with overall satisfaction rising by 20 points to 705 out of 1,000.

This surge in satisfaction stems from a renewed focus on personalized service, problem-solving, reducing fees, maintaining a manageable level of debt, improving overall creditworthiness, and financial guidance - areas where American Riviera Bank excels.

Small business owners can increase their loan approval chances by:

As a preferred lender, American Riviera Bank specializes in Small Business Administration (SBA) loans, empowering business owners to launch, expand, or refinance their ventures. Our team of experts is committed to guiding you through every step of the process, providing personalized support and answering your questions along the way.

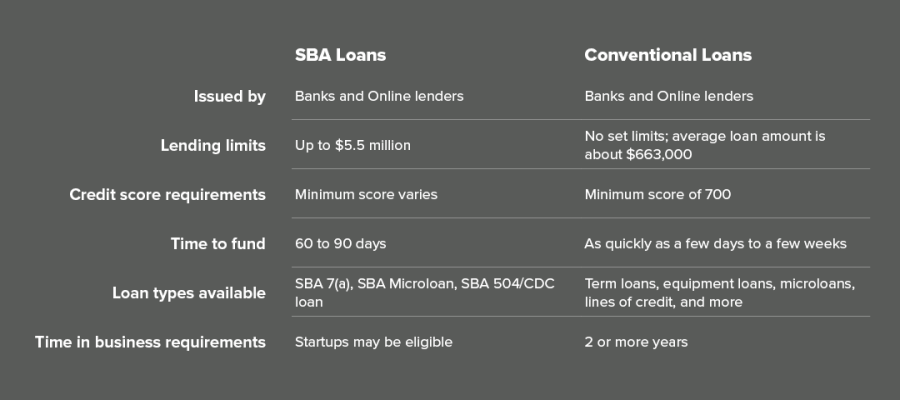

SBA loans are government-backed loans designed to help small businesses access financing. SBA loans are partially guaranteed by the U.S. Small Business Administration, which reduces the risk for lenders and often results in more favorable terms for borrowers.

Eligibility for SBA loans generally includes for-profit businesses operating in the United States that meet the SBA's definition of a small business. This definition varies by industry but is typically based on factors like annual revenue or number of employees. Additionally, businesses must have exhausted other financing options, demonstrate good character and credit, and show the ability to repay the loan. Certain businesses, such as non-profits, real estate investment firms, and gambling operations, are typically ineligible for SBA loans and explore traditional financing.

While funding matters, it's just one part of success. As your company grows, so does your need for business solutions such as:

Whether you're considering an SBA loan or exploring other growth strategies, we're here to help. Our experts can guide you through your options or refer you to other local resources that best fit your needs. Every successful business starts small. Let's work together to make those dreams a reality.

At American Riviera Bank, you can count on fast, local decision-making as industry experts work alongside you to design creative solutions to fit your needs. In addition, as a top SBA lender, we can provide more flexible terms and conditions depending on your growth stage, including business acquisition loans or longer terms to repay the loan. Through our partnerships with organizations such as Cal Coastal, a nonprofit public-benefit corporation chartered by the state of California, we can also support businesses that are not yet ready for more traditional financing.

For more information on business services including small business loans, please visit ARB.BANK.

Member FDIC | Equal Housing Lender

All loans are subject to credit approval. SBA loans are subject to SBA eligibility.