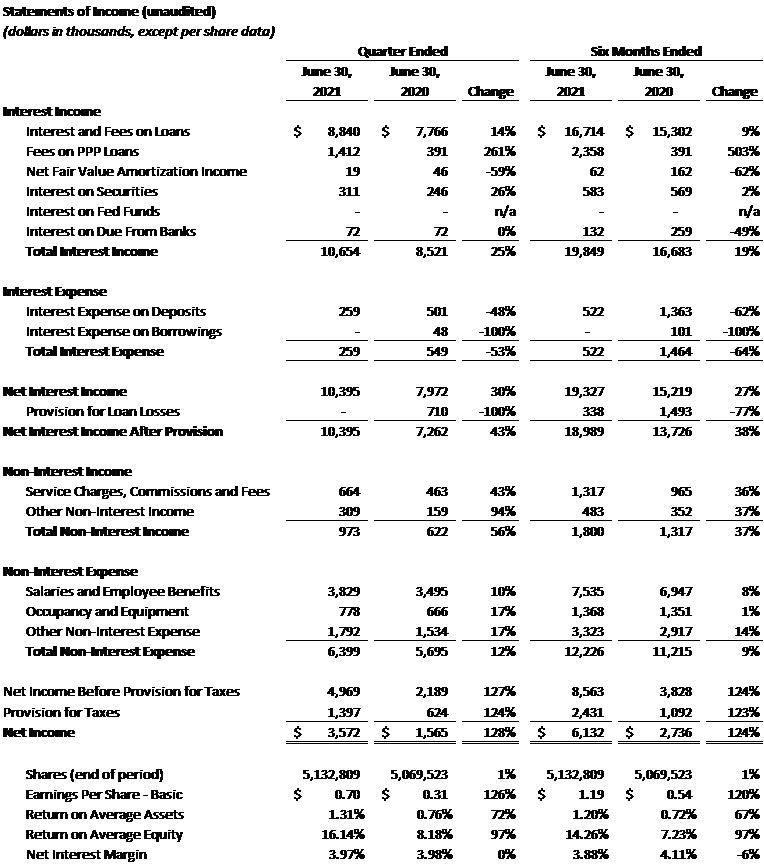

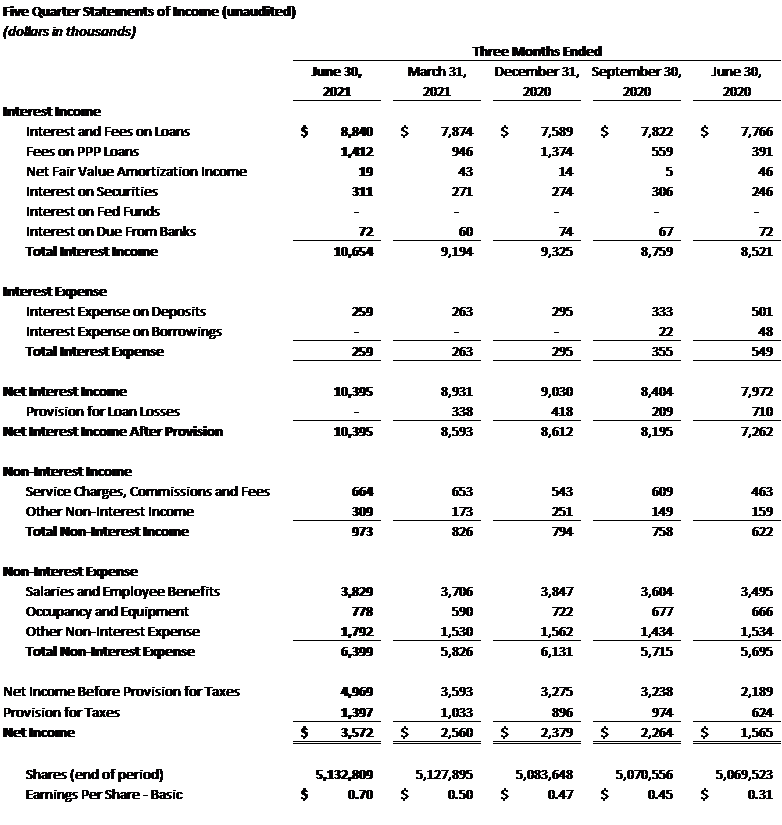

American Riviera Bank (OTCQX: ARBV) announced today unaudited net income of $6,132,000 ($1.19 per share) for the six months ended June 30, 2021. This represents a 124% increase in net income from the $2,736,000 ($0.54 per share) earned in the same reporting period in the prior year.

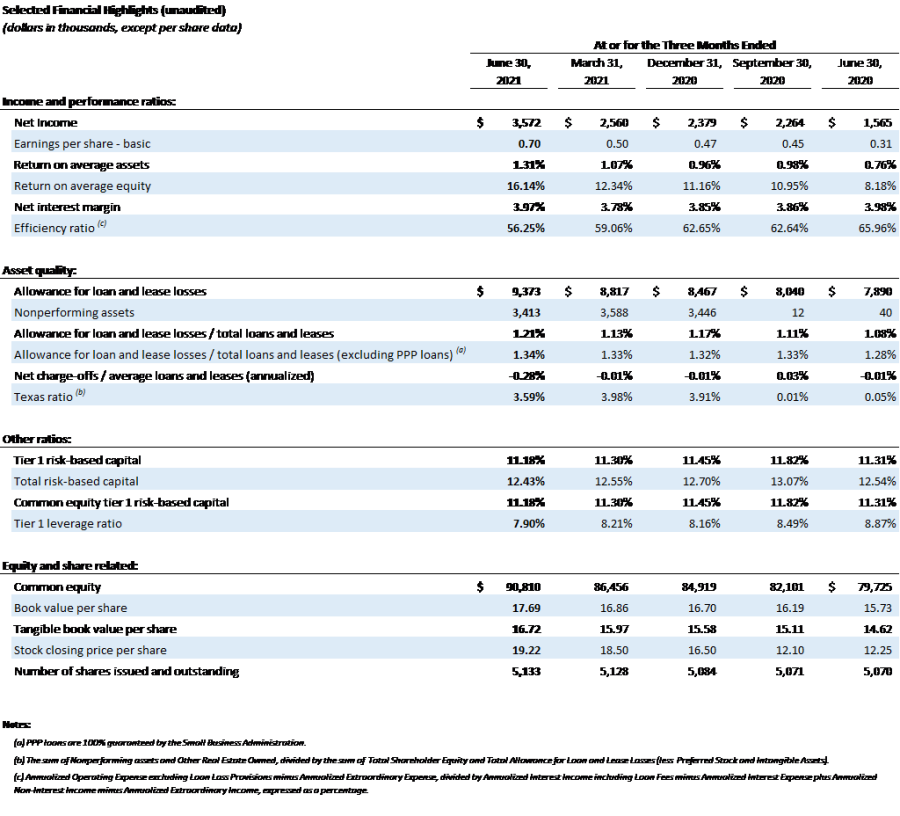

In 2021, the Bank has achieved an annualized return on average assets of 1.20% and return on average equity of 14.26%. Unaudited net income was $3,572,000 ($0.70 per share) for the second quarter ended June 30, 2021, compared to the $1,565,000 ($0.31 per share) earned in the same reporting period in the prior year. Net income in the second quarter of 2021 was positively impacted by a $751,000 loan interest recovery and accelerated recognition of Paycheck Protection Program (PPP) fee income upon loan forgiveness by the Small Business Administration (SBA).

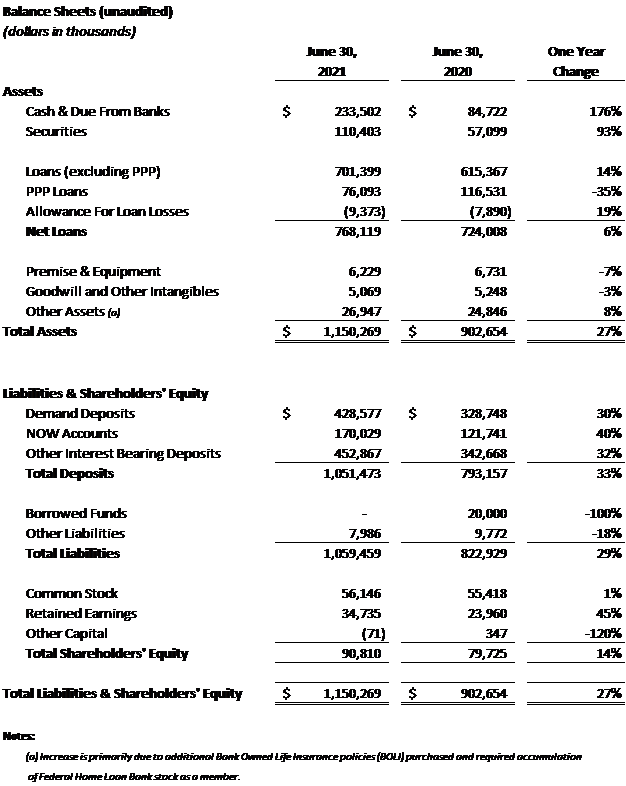

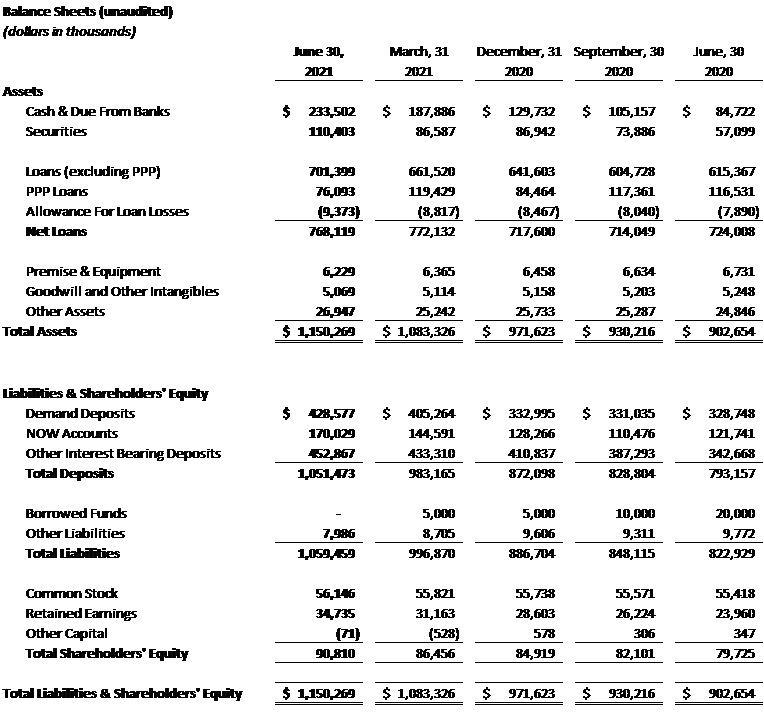

Core loans, excluding SBA PPP loans, have grown 14% or $86 million over the last year since June 30, 2020. Year to date, core loans excluding PPP loans have grown 9% or $60 million since December 31, 2020. PPP loans totaled $76 million at June 30, 2021, with $78 million processed by the Bank and approved for forgiveness by the SBA during the six months ended June 30, 2021. The Bank maintained strong credit quality with no other real estate owned, no loans 90 days or more past due, and only $3.4 million or 0.48% of total loans excluding PPP on non-accrual status, which are well supported by collateral.

American Riviera Bank continues to experience tremendous deposit growth with a 33% or $258 million increase in total deposits over the last year since June 30, 2020. Non-interest bearing demand deposits increased 30% or $100 million since June 30, 2020. Deposit inflows from our clients have been the driving factor in the total assets of the Bank increasing $248 million since June 30, 2020 to a total of $1.15 billion at June 30, 2021.

Jeff DeVine, President and Chief Executive Officer noted, “We are pleased as our community recovers from the pandemic to put deposits to work funding loans to local businesses and real estate projects. The Bank has been working closely with our clients to process and obtain prompt forgiveness decisions from the SBA, which has contributed to strong PPP fee income recognition this year. We will continue to make significant investments in people, products and technology to support our clients and the communities of the Central Coast.”

As of June 30, 2021, American Riviera Bank continues to be well capitalized with a Tier 1 Capital Ratio of 11% (well above the regulatory guideline of 8% for well capitalized institutions). The tangible book value per share of American Riviera Bank common stock was $16.72 at June 30, 2021.

Statements concerning future performance, developments or events concerning expectations for growth and market forecasts, and any other guidance on future periods, constitute forward looking statements that are subject to a number of risks and uncertainties. Actual results may differ materially from stated expectations. Specific factors include, but are not limited to, effects of interest rate changes, ability to control costs and expenses, impact of consolidation in the banking industry, financial policies of the US government, and general economic conditions.