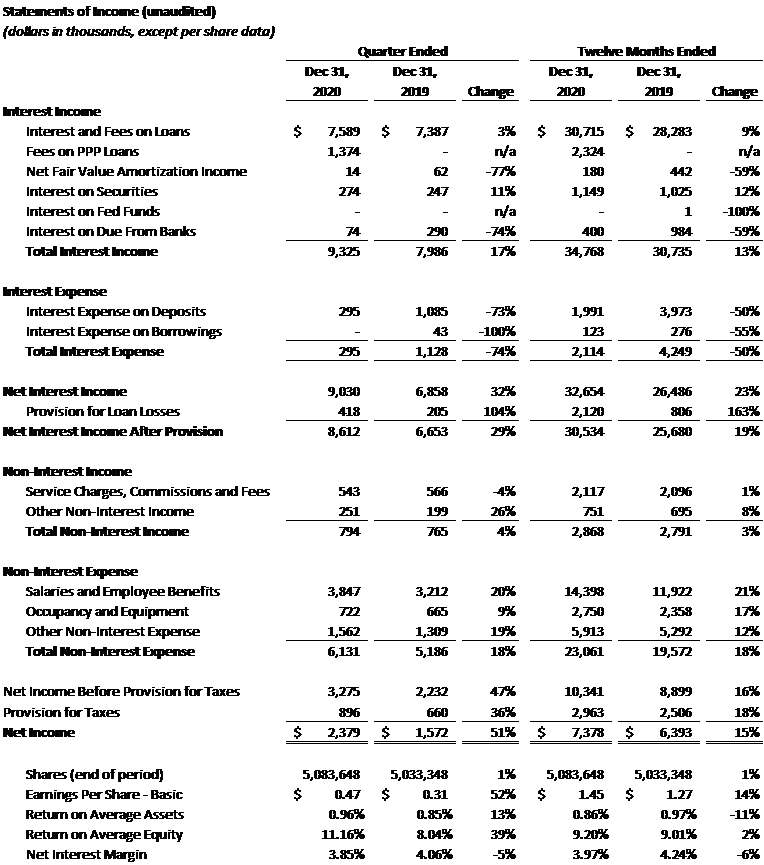

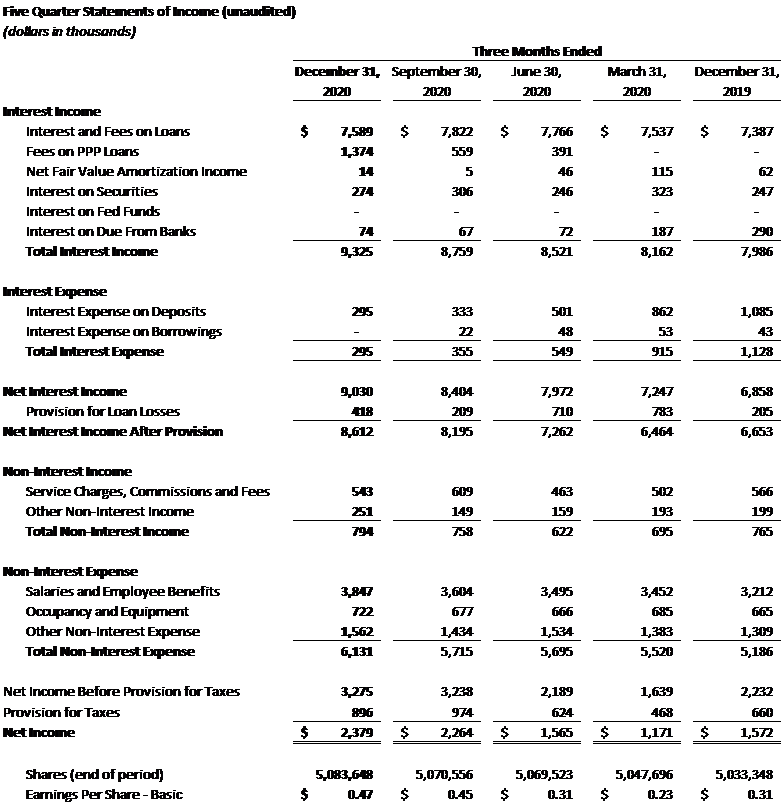

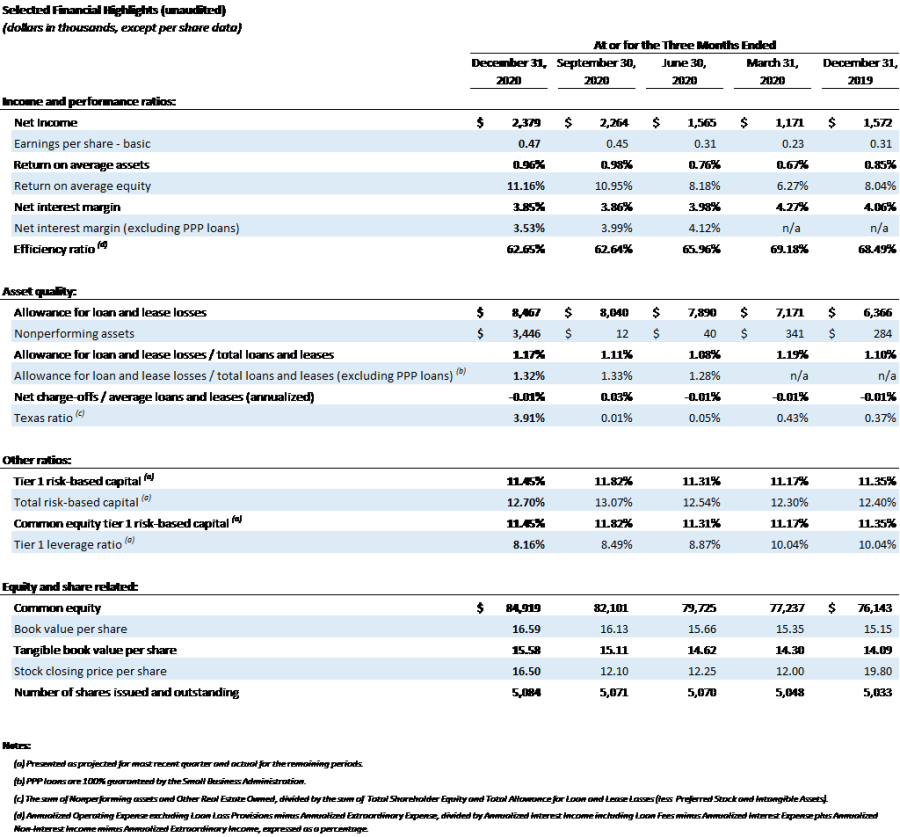

American Riviera Bank (OTC Markets: ARBV) announced today record unaudited net income of $7,378,000 ($1.45 per share) for the twelve months ended December 31, 2020. This represents a 15% increase in net income from the $6,393,000 ($1.27 per share) for the same reporting period in the prior year. The Bank reported unaudited net income of $2,379,000 ($0.47 per share) for the fourth quarter ended December 31, 2020. This represents a 51% increase from the $1,572,000 ($0.31 per share) for the same quarter last year.

“American Riviera Bank is proud to serve an important role in providing economic stability to the Santa Barbara and San Luis Obispo counties while also reporting strong earnings to our shareholders. During these unprecedented times, the Bank originated tremendous SBA PPP loan volume while still growing non-PPP loans at a double digit pace. Our branch network, drive-ups, ATMs, and robust digital banking capabilities allowed us to deliver uninterrupted depository services despite the COVID-19 pandemic and related stay-at-home orders. I thank our frontline team members, and those working from their office or remotely from home, who quickly adapted and safely helped our clients and communities in 2020.”

Jeff DeVine, President and Chief Executive Officer

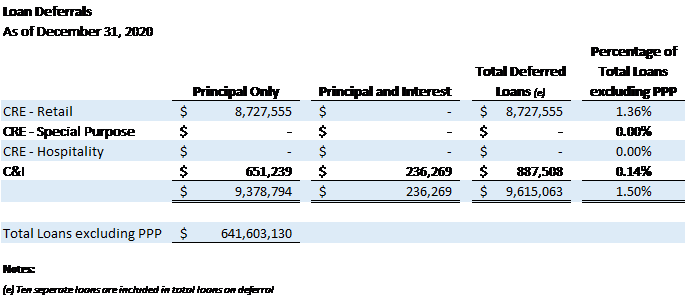

The Bank has seen a continued decrease in temporary loan payment deferrals for clients negatively affected by the COVID-19 pandemic. Total loans on deferral at December 31, 2020 were approximately $9.6 million, representing 1.5% of total loans excluding SBA PPP, and have fallen from the $18 million reported at September 30, 2020. The deferrals are primarily to borrowers wishing to conserve cash for the economic uncertainty, and who have asked for the principal portion of their payments to be deferred while continuing to pay interest (see detail on Loan Deferrals exhibit). The sizeable increase in loan loss provision in 2020 was primarily driven by qualitative factors in our loan loss methodology related to COVID-19 pandemic economic uncertainty, and not by actual delinquencies or defaults. At December 31, 2020, the Bank had no other real estate owned, no loans 90 days or more past due, and only $3.4 million or 0.53% of total loans excluding PPP on non-accrual status which are well supported by collateral.

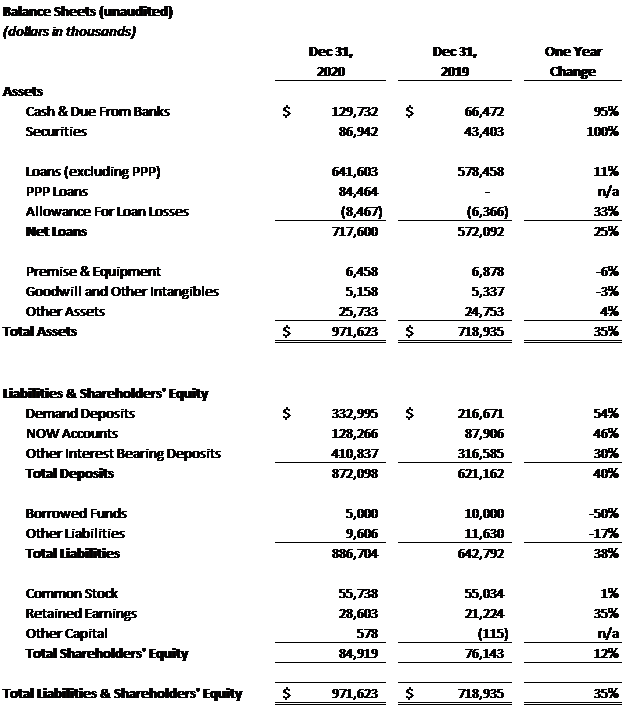

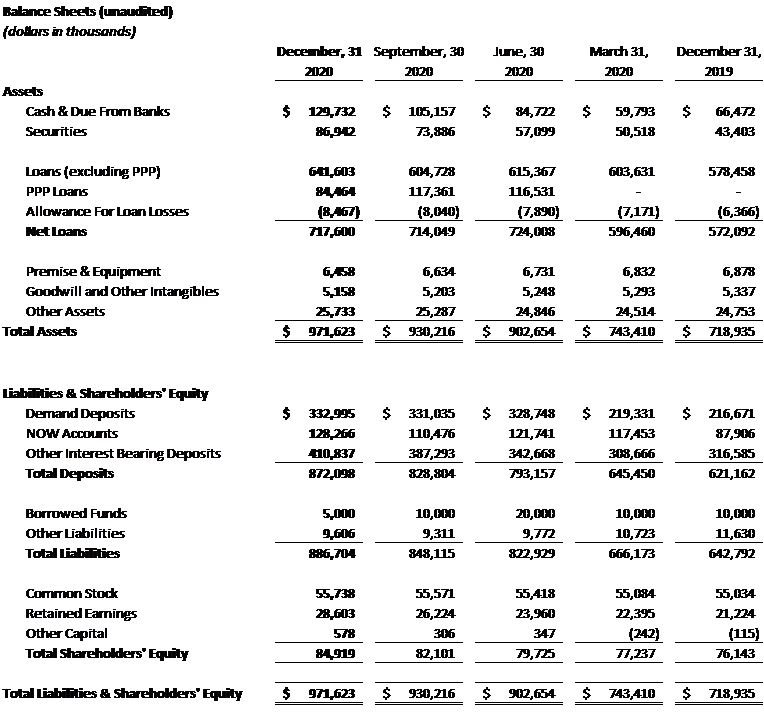

The Bank has experienced tremendous growth in new and existing relationships, reporting $972 million in total assets as of December 31, 2020, which represents a $253 million or 35% increase from December 31, 2019. Total loans including SBA PPP increased 26% from December 31, 2019, reaching $726 million at December 31, 2020. Total loans excluding SBA PPP increased $63 million or 11% from December 31, 2019, reaching $642 million at December 31, 2020. Total deposits increased 40% from December 31, 2019, reaching $872 million at December 31, 2020. Non-interest bearing demand deposit accounts increased $116 million or 54% from the same reporting period in the prior year.

As of December 31, 2020, American Riviera Bank was highly liquid with $217 million in cash and available-for-sale securities, and well capitalized with a Tier 1 Capital Ratio of 11% (well above the regulatory guideline of 8% for well capitalized institutions). The tangible book value per share of American Riviera Bank common stock was $15.58 at December 31, 2020.