Santa Barbara, California (April 26, 2021) – American Riviera Bank (OTC Markets: ARBV) announced today that assets exceeded $1 billion during the quarter, and totaled $1,083,326,000 at March 31, 2021.

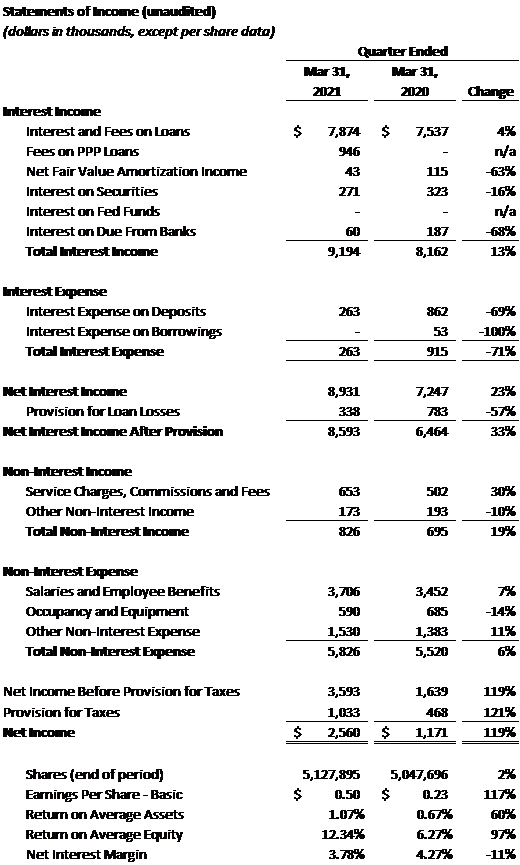

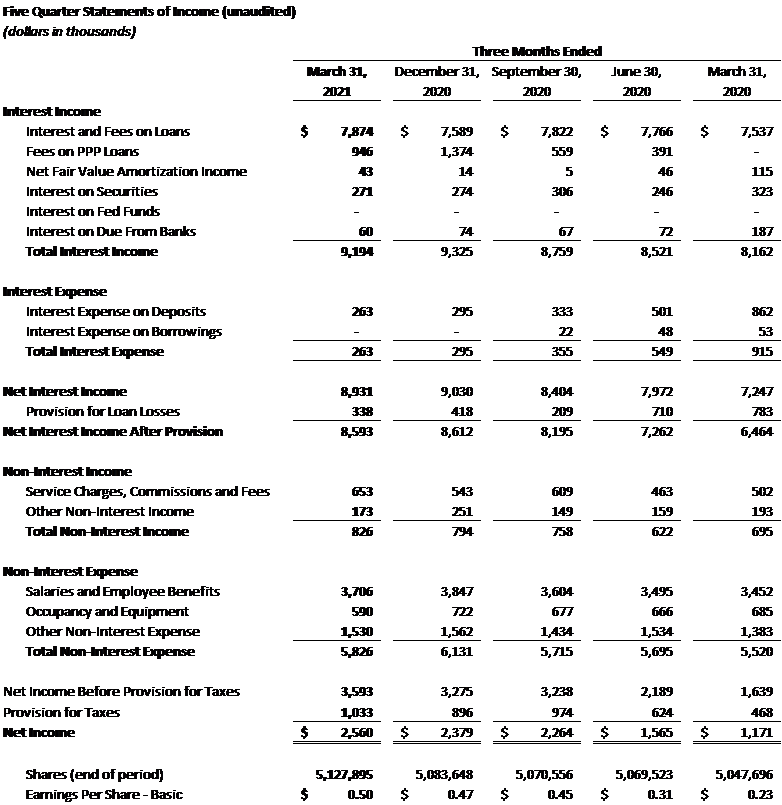

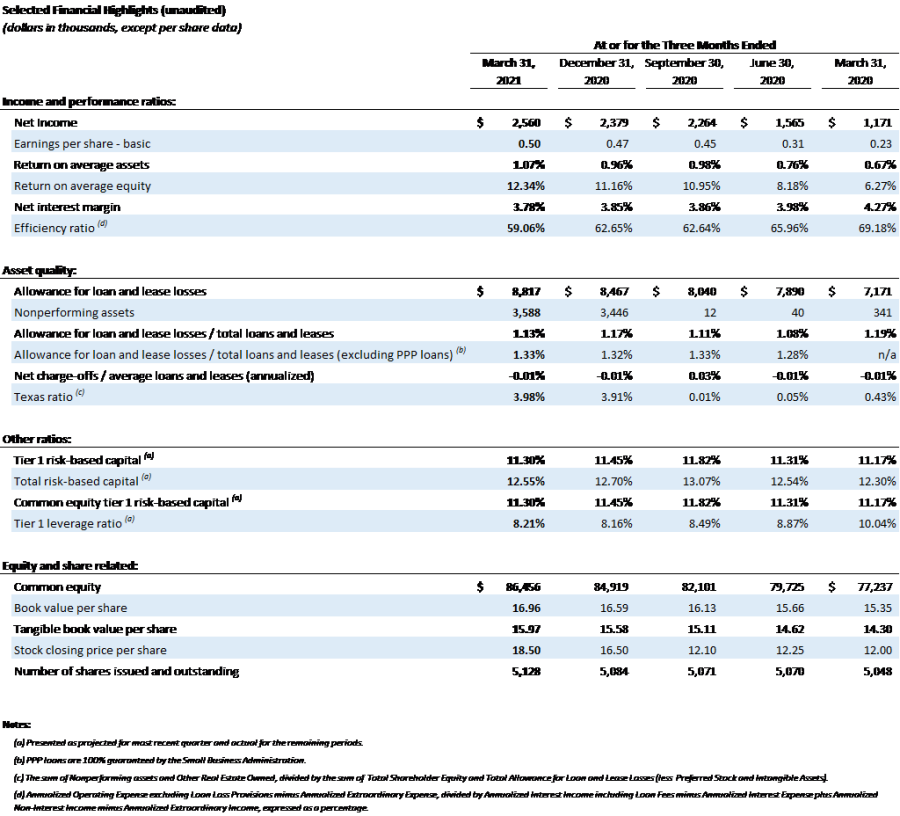

The Bank achieved record unaudited net income of $2,560,000 ($0.50 per share) for the three months ended March 31, 2021. This represents a 119% increase in net income from the $1,171,000 ($0.23 per share) for the same reporting period in the prior year, and an 8% increase in net income from the $2,379,000 ($0.47 per share) reported for the prior quarter ended December 31, 2020. The Bank reported an annualized return on average assets of 1.07% and return on average equity of 12.34% for the quarter ended March 31, 2021.

Larry Koppelman, Chair of the Board of Directors of the Bank stated, “Reaching $1 billion in assets is a significant milestone for the Bank and is a reflection of our growing and loyal client base on the Central Coast. It does present increased regulatory compliance expectations, but we have made the necessary investments in advance of reaching that milestone. We are proud of the hard work and dedication of our employees that made this milestone possible,” he noted, “and on behalf of the Board of Directors, we owe them our gratitude for both their contribution to the Bank’s success and superior service to our clients.”

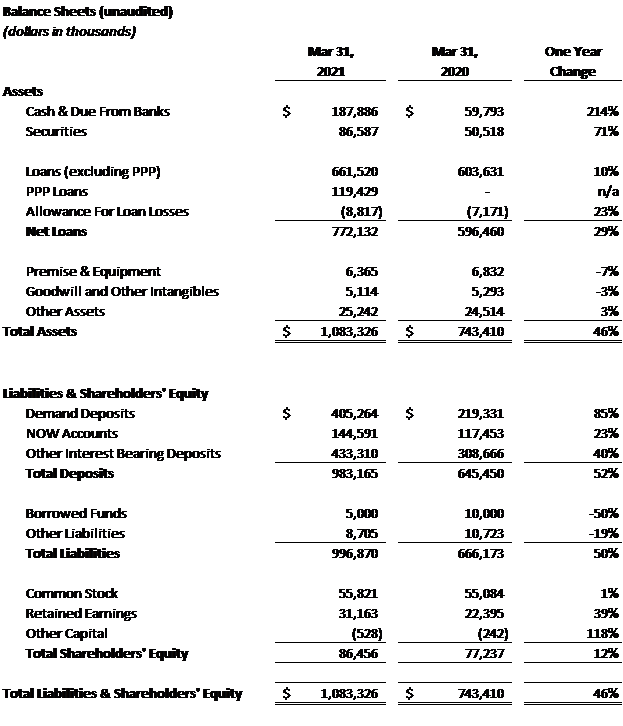

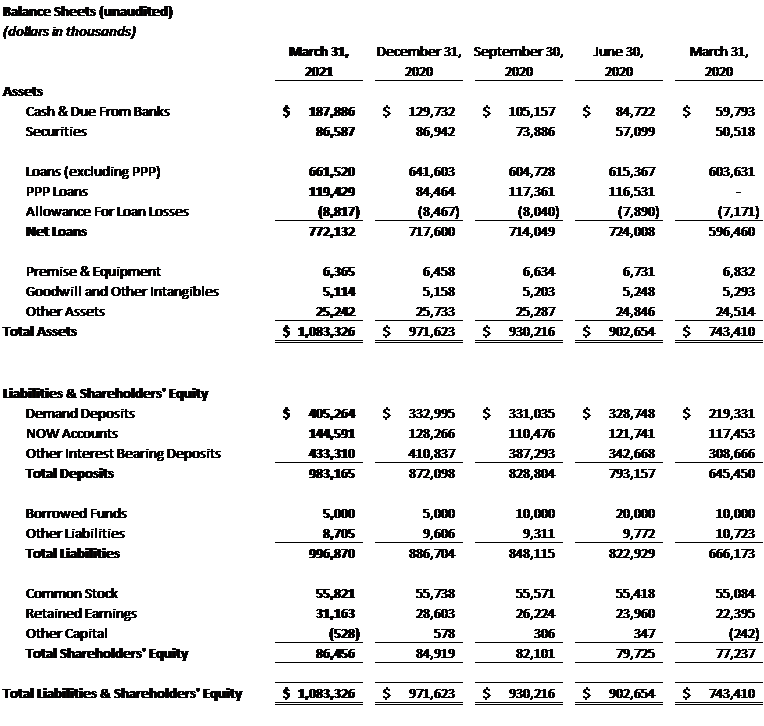

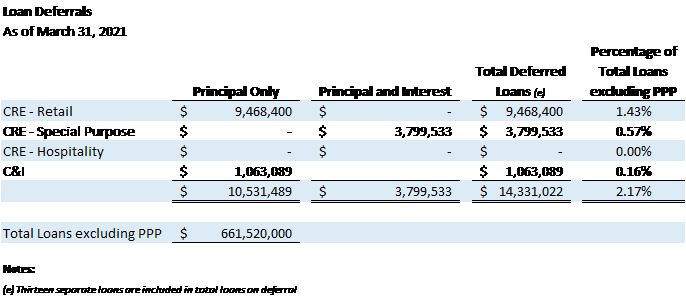

American Riviera Bank continues to experience tremendous loan and deposit growth, reporting 29% growth in loans and a 52% increase in deposits since March 31, 2020. Total loans, excluding SBA Paycheck Protection Program (PPP) loans, increased $58 million or 10% from March 31, 2020, reaching $662 million at March 31, 2021, primarily due to continued demand for residential real estate and commercial real estate loans. The Bank maintained strong credit quality with no other real estate owned, no loans 90 days or more past due, and only $3.6 million or 0.54% of total loans excluding PPP on non-accrual status, which are well supported by collateral. Total deposits increased $338 million from March 31, 2020, reaching $983 million at March 31, 2021. Non-interest bearing demand deposit accounts increased $186 million or 85% from the same reporting period in the prior year.

Jeff DeVine, President and Chief Executive Officer noted, “We funded $118 million in PPP loans to 614 businesses in 2020, and our SBA Department has been actively assisting clients to obtain forgiveness on these loans since last September. Through March 31, 2021, more than 50% of those clients have received forgiveness, totaling over $60 million in forgiven PPP loans.” Said DeVine, “We continue to assist our clients with their forgiveness requests, while also originating First and Second Draw PPP loans under the 2021 appropriation from Congress. Since December 31, 2020, an additional 420 PPP loans have been originated totaling $68 million. It has been an honor to support local businesses and jobs throughout the pandemic.”

As of March 31, 2021, American Riviera Bank continues to be well capitalized with a Tier 1 Capital Ratio of 11% (well above the regulatory guideline of 8% for well capitalized institutions). The tangible book value per share of American Riviera Bank common stock was $15.97 at March 31, 2021.

Statements concerning future performance, developments or events concerning expectations for growth and market forecasts, and any other guidance on future periods, constitute forward looking statements that are subject to a number of risks and uncertainties. Actual results may differ materially from stated expectations. Specific factors include, but are not limited to, effects of interest rate changes, ability to control costs and expenses, impact of consolidation in the banking industry, financial policies of the US government, and general economic conditions.