We wrote previously about delays in approvals on new PPP loans as a result of the new compliance checks put in place by the SBA to prevent against potential fraud. Just yesterday, the SBA announced a lender training to cover updates to their new Procedural Notice on revised PPP platform procedures for hold codes and compliance check error messages. As a result of the system and process issues, the rate of approvals for Round 3 has been significantly slower than either of the first two rounds. The SBA issued a press release indicating that they had approved almost 1.3 million PPP loans totaling $101 billion from January 11 through February 7, which is approximately 35% of the total appropriation for Round 3 of PPP funding.

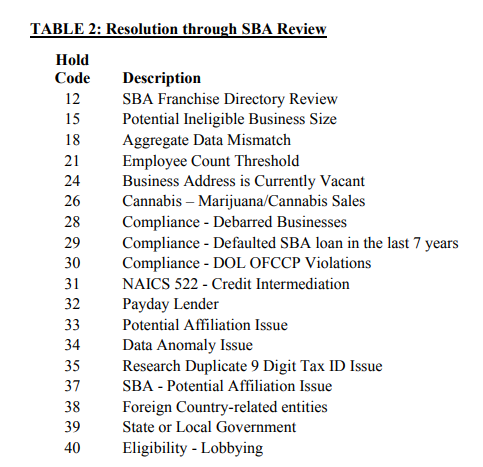

During the lender training held on Wednesday the SBA explained that, after the 2020 PPP loans were approved, they conducted certain compliance checks on those loan applications using an automated screening tool leveraging public records along with eligibility and fraud detection rules, combined with information from the Treasury Department's "Do Not Pay" lists. If a potential issue was identified with a borrower’s First Draw loan, the loan was assigned a “hold code” that had to be cleared before forgiveness requests could be processed.

Fast forward to 2021, any application for a Second Draw loan where the borrower’s First Draw loan has a hold code is now assigned a “compliance error message”. First Draw applications in 2021 are being screened now BEFORE loan approval, so compliance errors are also being assigned to First Draw loan applications where the fraud screening detects potential issues. The issues noted on the First Draw loan must be cleared before a Second Draw loan can be approved by the SBA for the same applicant. The good news is the SBA has stated that no additional work is required to advance the Second Draw loan for approval once the First Draw loan is “cleared”. However, there may be additional documentation requirements in order to clear the First Draw loan before that can happen.

In some cases, lenders are now able to collect documentation from the borrower and perform a certification to the SBA that sufficient documentation exists to clear the error. One such error is “Applicant Tax ID Discrepancy/Mismatch of TIN (EIN/SSN)”, which is probably the most common error we are seeing. The SBA noted that the edit check is in place to ensure that businesses are not attempting to change their Tax ID number to obtain multiple First Draw or multiple Second Draw loans from different lenders.

However, sole proprietors who are legitimately applying for a Second Draw loan may have used their personal SSN on their First Draw loans, consequently receiving a hold code if they instead used their EIN on their tax filings, such as their 941s. When we submit the Second Draw application using the correct EIN, we then get an error message that it is a different Tax ID than was reported for the First Draw. A true catch 22! We’ve been able to correct the First Draw loan in ETRAN with the EIN used in tax filings, then submit the application for the Second Draw loan using the correct EIN. As of last night, the SBA will now allow us to clear these issues through a lender certification provided we have evidence (such as a tax return) with the correct EIN. The issue arises when a different lender processed the First Draw loan. In such cases, it is up to the original lender to clear the hold in order to advance the Second Draw loan application.

There are other Hold Codes on First Draw loans that cannot be cleared through a lender certification, including loans that may not have been eligible for a PPP loan, including an ineligible business size, which was 500 or less employees for a First Draw loan and has been reduced to 300 or less employees for the Second Draw loan. Other ineligibility issues include Credit Intermediaries, such as lenders with a NAICS code beginning with 522, or potential affiliation issues where the borrower did not disclose affiliates that may have disqualified them from receiving a PPP loan due to the combined size of the businesses. As we’ve previously discussed, the SBA has published information on the Affiliation Rules, which includes four “tests” for determining if one business is affiliated with another.

These Hold Codes are more challenging to resolve, as it may take the SBA a period of time to review the documentation, and potentially request additional documentation, before the Hold Code can be resolved. We posted information on documentation that may be required to clear these errors in our January 28 blog post, and want to remind borrowers to review the SBA’s list of potential documentation requirements for clearing Hold Codes so you are prepared if and when we request additional documentation to process the application.

Stay well, and thanks for reading!

Previous: Cost vs. Quality Next: Reducing Your Food Bill