Updated 3/5/2021

Click here to access the recording of our March 4, 2021 PPP Forgiveness Webinar.

We continue to update this page to incorporate guidance from the changing rules. Please review our FAQs below, and our Forgiveness Borrower Guide for information on what will be required. You can also review our Guide for loans that do not receive full forgiveness here.

You can also visit the US Chamber of Commerce site to download the US Chamber Guide to Forgiveness here.

Yes, according to the "Loan Forgiveness Requirements and Loan Review Procedures as Amended by the Economic Aid Act," it says:

When must a borrower apply for loan forgiveness or start making payments on a loan? A borrower may submit a loan forgiveness application any time on or before the maturity date of the loan if the borrower has used all of the loan proceeds for which the borrower is requesting forgiveness, except that a borrower applying for forgiveness of a Second Draw PPP Loan that is more than $150,000 must submit the loan forgiveness application for its First Draw PPP Loan before or simultaneously with the loan forgiveness application for its Second Draw PPP Loan.

Our online portal has been updated to reflect a covered period from 8 to 24 weeks at the borrower’s option.

According to the Interim Final Rule, borrowers that do not submit a loan forgiveness application within 10 months after the end of their loan forgiveness covered period must begin paying principal and interest at that time. In order to ensure the SBA can take action on your forgiveness application prior to the end of the 10 months, we recommend submitting your application no later than 120 days prior to the end of your loan forgiveness covered period.

The “loan forgiveness covered period” is the 24-week period beginning on the date the PPP loan is disbursed; or, if the PPP loan was made before June 5, 2020, the borrower may elect to have the loan forgiveness covered period be the eight-week period beginning on the date the loan was disbursed. You may begin the 24 week covered period at any time; however, you will need to ensure you have utilized the loan proceeds prior to the end of the covered period to be eligible for full loan forgiveness.

The Interim Final Rules issued on May 22, 2020 for Loan Forgiveness and section 1106(b) of the CARES Act indicate that PPP loans shall be eligible for forgiveness in an amount equal to the sum of the following costs (subject to several important limitations):

The Interim Final Rule for the Paycheck Protection Program as amended by the Economic Aid Act also adds the following eligible costs for PPP loan proceeds.

Also, in the Final Interim Rule issued on May 22, 2020 on Loan Forgiveness, the Administrator of the SBA, in consultation with the Secretary of the Treasury, determined that if an employee’s compensation does not exceed $100,000 on an annualized basis, an employee’s hazard pay and bonuses are also eligible for loan forgiveness because they constitute a supplement to salary or wages, and are thus a similar form of compensation. Note that documentation will be necessary to support eligible payroll costs.

Eligible nonpayroll costs cannot exceed 40 percent of the loan forgiveness amount based on the PPP Flexibility Act signed into law on June 5, 2020. In order to qualify for partial forgiveness, 60 percent or more of the loan forgiveness amount must be used for payroll costs.

If a borrower is paying rent to a related party, they can only qualify for forgiveness in the amount of the mortgage interest owed during the covered period that can be attributed to the space being rented by the business (not subtenants). Also, both the lease and the mortgage must have been entered into prior to February 15, 2020. In this context, the related party itself would not also be eligible to request forgiveness for this amount. The term "related party is defined as any ownership in common between the borrower and the property owner.

Any ownership in common between the business and the property owner is a related party for these purposes. The borrower must provide mortgage interest documentation to substantiate these payments. Mortgage interest payments to a related party are not eligible for forgiveness.

PPP Loans are intended to help businesses cover certain non-payroll obligations that are owed to third parties, not payments to a business's owner that occur because of how the business is structured. This will maintain equitable treatment between a business owner that holds property in a separate entity and one that holds the property in the same entity as its business operations.

No, the latest Interim Final Rule on Certain Nonpayroll Costs indicates that if the Borrower has a sub-tenant or leases out portion of building (on which they area claiming rent or interest) the amount of loan forgiveness requested for nonpayroll costs may not include any amount attributable to the business operation of a tenant or sub-tenant of the PPP borrower or, for home-based businesses, household expenses. Refer to the IFR for additional information.

Mortgage interest payments for real or personal property that were in existence prior to February 15, 2020 are eligible for loan forgiveness. Note that interest on unsecured credit incurred before February 15, 2020, is a permissible use of loan proceeds under SBA guidance; however, this expense is not eligible for loan forgiveness. The FAQs also provide that interest payments on a refinanced mortgage loan during the Covered Period are eligible for loan forgiveness if the mortgage loan was on real or personal property that existed prior to February 15, 2020, and is refinanced on or after February 15, 2020.

If you received loan approval prior to June 5, 2020 you may elect an 8-week covered period for spending your PPP loan. If you elect 8 weeks, an employee earning a salary of $100,000 is capped for loan forgiveness at $15,384, dividing $100,000 by 52 weeks and then multiplying that out for the 8-week period. If, however, you elect the 24-week covered period made available under the PPP Flexibility Act you are capped at $46,154 per individual. Please keep in mind that you were only eligible for a maximum PPP loan amount under the SBA PPP Loan Application Form 2483 that was 2.5X your average monthly payroll costs, or (for a Second Draw PPP loan) 3.5X your average monthly payroll if your business is in the Accommodation and Food Services sector and the business activity code reported on your most recent tax return begins with 72. So, this new per-individual maximum would only be reached if you reduced employee hours or wages from what was considered in your original loan application.

Your total loan forgiveness amount will never be more than the full principal amount of the original loan, plus accrued interest. In addition, if you reduced employee hours (based upon the full-time equivalent calculation described below) you must be eligible for an exemption (safe harbor) or you will reduce the total amount of your loan forgiveness.

According to the latest IFR loan forgiveness continues to be capped for borrowers that are individuals with self-employment income who file a Form 1040, Schedule C or F by their owner compensation replacement:

“forgiveness is capped at 2.5 months’ worth (2.5/12) of an owner-employee or self-employed individual’s 2019 or 2020 compensation (up to a maximum $20,833 per individual in total across all businesses”.

The January 17, 2021 revisions to the Loan Forgiveness and Loan Review Procedures Interim Final Rules also specify that:

No additional forgiveness is provided for retirement or health insurance contributions for self-employed individuals, including Schedule C filers and general partners, as such expenses are paid out of their net self-employment income.

According to recent SBA guidance, owners with less than 5% ownership are not subject to the owner caps.

If we determine that only a portion of your loan is eligible for forgiveness, or if the forgiveness request is denied by us or the SBA, any remaining balance due on the loan must be repaid by the borrower on or before the two-year maturity of the loan in accordance with the terms outlined in the PPP Loan Agreement you signed with American Riviera Bank. If you received your PPP loan after June 5, 2020, the repayment term is extended to five years.

The SBA and U.S. Treasury, using joint rulemaking authority, has issued a new two-page, streamlined application, which exempts borrowers of less than $150,000 from forgiveness penalties for reducing the number of full-time employees or salaries/wages and requires fewer calculations. Borrowers may still be required to provide the same documentation to support their calculations on payroll and nonpayroll costs to their lender as with the EZ application form upon SBA request within 5 business days upon SBA request. In addition, borrowers must still submit documentation with their forgiveness application for Second Draw loans to evidence a 25% reduction in revenue over 2019 if it was not provided at the time of application.

Many borrowers have found it easier to leverage the EZ application form, which we provide with automatic calculation tools for ease of use.

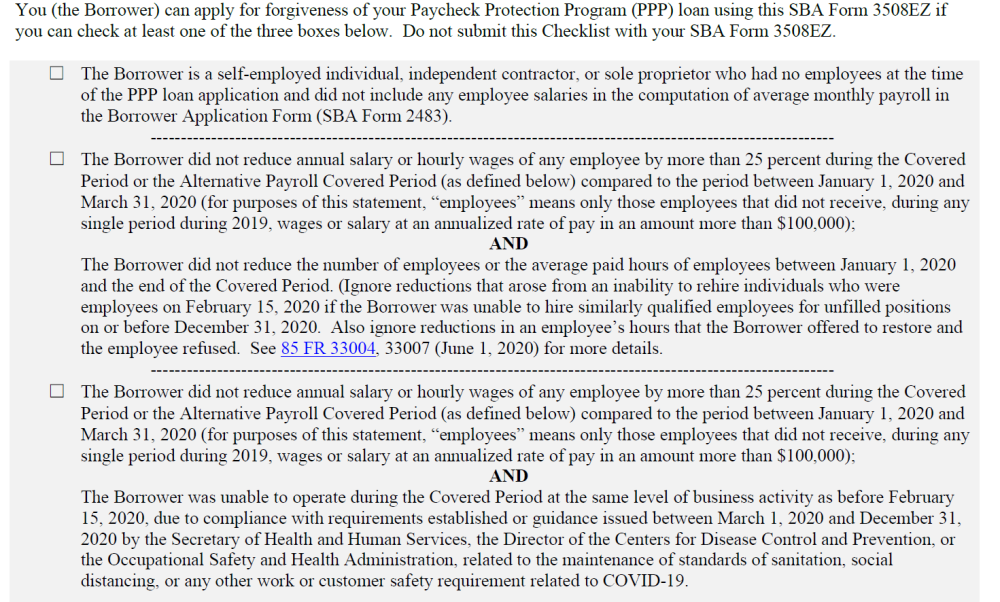

The EZ Forgiveness application is available to self-employed borrowers without employees and to employers who did not reduce individual employee wages or salaries by more than 25% from pre-pandemic levels. Instructions for the EZ form also assist you in determining if you qualify for the EZ Forgiveness application.

To upload documents, you can only upload one at a time and each must be associated with at least one line item on the application; however, there is now a section to “Upload Additional Documents” section that can be used as catch-all for additional documents.

Once a complete application is received, lenders have 60 days to make a determination on loan forgiveness under the PPP. Under the new SBA Loan Review Interim Final Rule, the SBA has up to 90 days to review a PPP Loan Forgiveness Application upon receiving a determination from a lender. That 90-day window will be extended if the SBA requests additional information to complete an application for forgiveness.

Prior guidance by the SBA indicated that the “covered period” for forgiveness was the 8-week period beginning when your PPP loan was funded; however, the PPP Loan Forgiveness Application issued on May 15, 2020 also provides the option for borrowers to calculate payroll costs using an “alternative payroll covered period that aligns with borrowers’ regular payroll cycles”.

Borrowers with a biweekly (or more frequent) payroll schedule may alternatively elect to calculate eligible payroll costs using the eight-week (56-day) period that begins on the first day of their first pay period following their PPP Loan Disbursement Date (the “Alternative Payroll Covered Period”).

For example:

Borrower received its PPP loan proceeds on Monday, April 20, and the first day of its first pay period following its PPP loan disbursement is Sunday, April 26.

The first day of the Alternative Payroll Covered Period is April 26 and the last day of the Alternative Payroll Covered Period is Saturday, June 20.

BUT, Borrowers must apply the Covered Period (not the Alternative Payroll Covered Period) wherever there is a reference in this application to “the Covered Period” only, such as when calculating business mortgage interest payments, utility payments, and other nonpayroll expenses.

The PPP Flexibility Act also allows borrowers to elect to extend the covered period for using the forgivable expenses to 24 weeks.

The application indicates that documentation verifying the eligible cash compensation and non-cash benefit payments from the Covered Period or the Alternative Payroll Covered Period consists of each of the following:

NOTE: Be sure to document that expenses were both incurred and paid in the covered period (with exceptions as described below).

NOTE: Owners with 20% or more equity in the business may not include draws in the forgiveness amount. Owner draws, distributions, amounts recorded on a K-1 are not eligible for the PPP program. Instead, we will need a W-2 showing what the owner was paid in 2019 or 2020.

The Interim Final Rule indicates that payroll costs “incurred but not paid during the Borrower’s last pay period of the Covered Period” can be included if paid “on or before the next regular payroll date”. Evidence of final proof of payment will be required before we can submit your forgiveness application to the SBA. However, FAQ’s issued by the SBA indicate that eligible business mortgage interest costs, eligible business rent or lease costs, and eligible business utility costs incurred prior to the Covered Period and paid during the Covered Period are eligible for loan forgiveness.

Example: A borrower’s 24-week Covered Period runs from April 20 through October 4. On May 4, the borrower receives its electricity bill for April. The borrower pays its April electricity bill on May 8. Although a portion of the electricity costs were incurred before the Covered Period, these electricity costs are eligible for loan forgiveness because they were paid during the Covered Period.

Evidence of the period covered by the utility bill will be required.

Documentation showing (at the election of the Borrower) should include:

The selected time period must be the same time period selected for purposes of completing the PPP Loan Forgiveness Application. According to the application instructions, documents may include payroll tax filings reported, or that will be reported, to the IRS (typically, Form 941) and state quarterly business and individual employee wage reporting and unemployment insurance tax filings reported, or that will be reported, to the relevant state.

In most cases, borrowers have been successful achieving forgiveness by electing the 24-week covered period and supplying documentation to support payroll costs alone; however, up to 40% of the loan proceeds can be used for nonpayroll eligible expenses. A non payroll cost is eligible for forgiveness if it is paid during the covered period or incurred during the covered period and paid on or before the next regular billing date, even if the billing date is after the covered period.

According to the application instructions, documentation verifying existence of the obligations/services prior to February 15, 2020 and eligible payments from the Covered Period includes:

NOTE: For the nonpayroll costs listed above, be sure to include evidence the contract/account existed on or before 2/15/2020.

The application instructions issued in 2021 also provide guidance for documentation on other eligible expenses authorized under the Economic Aid Act:

No. The Interim Final Rule issued by the SBA on Loan Forgiveness indicates that an eligible nonpayroll cost is one paid during the Covered Period “or incurred during the Covered Period and paid on or before the next regular billing date, even if the billing date is after the Covered Period”. In addition, as with payroll, we would have to wait for proof of payment prior to submitting your forgiveness application to the SBA.

While the rule indicates that nonpayroll costs can be paid “or” incurred and paid after the covered period, it does not mean that you will receive forgiveness consideration for prepaying such expenses during the Covered Period. The rule also clarifies that advance payments of mortgage interest are not eligible for loan forgiveness.

To obtain loan forgiveness, 60% or more of the amount spent must have been on payroll expenses as defined above. In addition, any individual salary or wage deductions must be taken into account and could reduce the overall loan forgiveness if such deductions exceed 25% of pre-pandemic levels. The Loan Forgiveness Interim Final Rule issued on May 22, 2020 clarifies that this reduction calculation is performed on a per employee basis, not in the aggregate. The rule also clarifies that if the borrower restores reductions made to employee salaries and wages by not later than June 30, 2020, the borrower is exempt from any reduction in loan forgiveness that would otherwise be required. Borrowers who elect 24 weeks for using their PPP loan proceeds have until December 31, 2020, or the end of the covered period, to restore any such reductions.

Finally, total FTE count must be the same or greater than pre-pandemic levels to qualify for full loan forgiveness; however, you may consider the FTE count in effect as of June 30, 2020 in determining whether you meet the threshold for full forgiveness. In addition, the PPP Flexibility Act extends the period in which employers may rehire or eliminate a reduction in employment, salary or wages that would otherwise reduce the forgivable amount of a PPP loan to December 31, 2020, or the end of the covered period.

The EZ form includes a Borrower Certification, “The Borrower did not reduce salaries or hourly wages by more than 25 percent for any employee during the Covered Period or Alternative Payroll Covered Period compared to the period between January 1, 2020 and March 31, 2020. For purposes of this certification, the term “employee” includes only those employees that did not receive, during any single period during 2019, wages or salary at an annualized rate of pay in an amount more than $100,000.”

If you reduced average wages during the “covered period” or “alternative covered period” by more than 25 percent compared to the average of what that employee was receiving in Q1 2020, you may still be eligible for partial loan forgiveness but you will be required to use the Full Loan Forgiveness Application, which includes the Schedule A Worksheet. You would list any employee paid during your elected “covered period” or “alternative covered period” who received compensation that, when annualized, is less than or equal to $100,000 and who was on your payroll during Q1 2020.

Long story short, if you did not reduce the annual salary or hourly wage during the covered period you elected for using your PPP loan proceeds, and you had no reduction in hours or any reduction in hours was because of lost business activity due to health directives related to COVID-19, you can save yourself some aggravation by electing to use the new 3508 EZ Form.

The applications include an exemption to the FTE count if jobs are restored by December 31, 2020, or the end of the covered period. BUT as noted above the forgiveness amount is the smaller of the 60% payroll threshold, PPP Loan Amount, or the Total Payroll and Nonpayroll Costs. If you did not spend sufficient money on payroll costs, you will have an outstanding loan balance with monthly payments over 2 years at a 1% interest rate, which has been extended to 5 years for PPP loans made after June 5, 2020. There are no penalties for repayment, however, so you can also save funds not spent on payroll costs to pay down the remaining balance.

In addition, under the PPP Flexibility Act, borrowers will not be penalized for any FTE reductions if either of the following occurred:

or

Under the Economic Aid Act, borrowers with a PPP loan of $50,000 or less, other than any borrower that together with its affiliates received PPP loans totaling $2 million or more, are also exempt from any reduction in loan forgiveness based on reductions on FTE employees or in employee salary and wages.

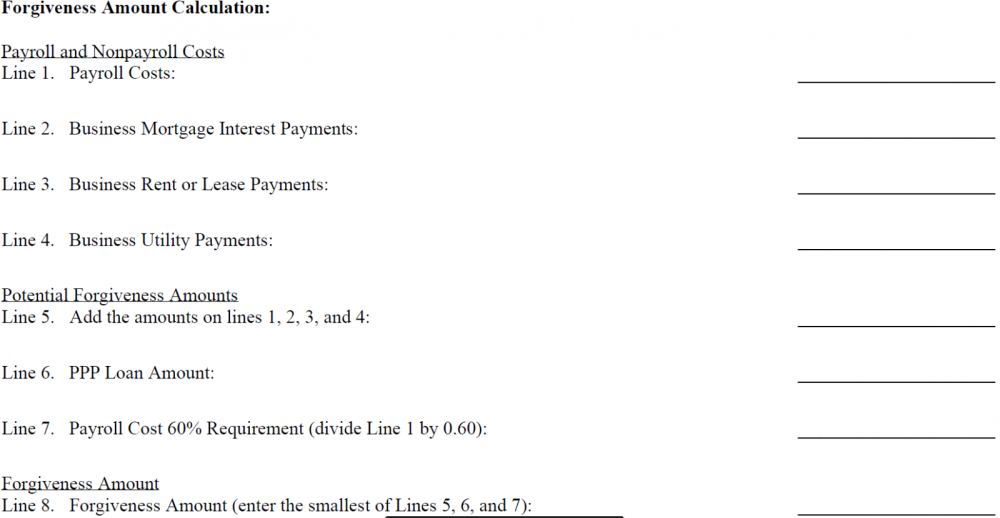

The PPP Loan Forgiveness Application Form 3508EZ instructions indicate that the forgiveness amount will be the smaller of the following calculations:

In accordance with the PPP Flexibility Act, no part of a loan will be forgiven if 60% or more of the reported eligible expenses are not used for “payroll costs”, specifically.

SBA guidance indicates that the EZ form can only be used when you:

Experienced reductions in business activity as a result of health directives related to COVID-19, and did not reduce the salaries or wages of their employees by more than 25%.

Under the PPP Flexibility Act signed into law on June 5, 2020, a borrower can now be eligible for full loan forgiveness if 60% or more of their loan forgiveness amount went towards payroll costs rather than the 75% originally mandated by the CARES Act. Loan forgiveness is based upon the smaller of your original loan amount, your eligible expenses, or your payroll costs plus up to 40% eligible nonpayroll expenses (which, algebraically, is payroll costs divided by 60% or .60).

So, let’s say you received a loan for $100,000. You spent $100,000 over the covered period.

You spent 60% or more on payroll expense so you could have received forgiveness for up to $125,000 if you divided those expenses by .60 per line 7 of the application form.

BUT, you cannot receive forgiveness for more than the original loan amount OR more than your actual expenses, so you would still only receive forgiveness for $100,000.

If that same borrower only spent $50,000 on payroll costs, they are only eligible for a maximum of $83,333 in total loan forgiveness. The remaining balance of the $100,000 loan would be have to be paid back at a rate of 1%, following a 10-month deferment of interest and principal.

Basically, the change allows someone who only spent $60,000 of the original $100,000 loan amount on payroll expense to be eligible for full loan forgiveness, assuming the remaining amount is used for eligible expenses. Loan forgiveness can also be reduced if you did not maintain or restore your FTE (and don’t have an eligible exemption) or if you reduced the salaries or wages of individual employees.

SBA and Treasury instituted an exception excluding laid-off employees whom the borrower offered to rehire (for the same salary/wages and same number of hours) from the CARES Act’s loan forgiveness reduction calculation. According to SBA FAQ 40 issued on May 13, 2020, the forgiveness amount will not be reduced for employee reductions related to:

Documentation will be required to support any such exemptions. In addition, the exemption for an employee who declined an offer of rehire only applies if:

In addition, there are exceptions to the requirement for rehiring or eliminating the reduction in employment, salary or wages if the recipient is unable by December 31, 2020 or the end of the covered period to return to the same level of business activity that existed prior to February 15, 2020, as a result of complying with federal COVID-19 requirements or guidance.

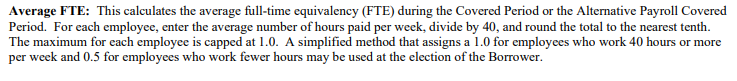

Borrowers must use their average employment over the same time periods to determine their number of employees, for the purposes of applying an employee-based size standard. In determining pre-pandemic Full-Time Equivalent (FTE) levels or the “selected reference period” for comparing to new levels, the instructions for line 11 of the application indicate that it is the Borrower’s election, to use either

The Loan Forgiveness Interim Final Rule issued on May 22, 2020 also indicates that in recognition that not all borrowers maintain hours-worked data, borrowers have flexibility in calculating the full-time equivalency of their part-time employees, and can either divide hour-worked by 40 hours, or adopt an alternative method by assigning 1.0 for employees working 40 hours or more per week, and .5 for employees who work fewer than 40 hours:

The application instructions remind the Borrower that the calculations on lines 11, 12, and 13 will be used to determine whether the Borrower’s loan forgiveness amount must be reduced based on reductions in full-time equivalent employees, as required by the statute.

It again reminds borrowers that the actual loan forgiveness amount that the Borrower will receive may be reduced if the Borrower’s average weekly FTE employees during the Covered Period (or the Alternative Payroll Covered Period) was less than during the Borrower’s chosen reference period. The Borrower is only exempt from such a reduction if the FTE Reduction Safe Harbor applies, which we discuss above.

The CARES Act only contemplated refinancing EIDLs received before April 3; however, the 2020 FAQs on Loan Forgiveness established that SBA would deduct the amount of any Economic Injury Loan (EIDL) advance received by a PPP borrower from the forgiveness amount remitted to the lender. The Economic Aid Act removed this requirement, and loans where the borrower applied for forgiveness on or after December 28, 2020 will no longer have the EIDL advance deducted from their forgiveness amount.

Yes. SBA may review any PPP loan as deemed “appropriate”, which could delay the decision on loan forgiveness by up to 90 days following the lender’s submission of their loan forgiveness determination to the SBA. In addition, for those loans that the SBA selects for review, the lender will be required to submit information to allow the SBA to review the loans for borrower eligibility, loan amount eligibility, and loan forgiveness eligibility. This last part is important as the new rule specifies that the “SBA may begin a review of any PPP loan of any size at any time in SBA’s discretion.”

Previously issued FAQ #46 indicated that PPP loans with an original principal amount of less than $2 million will be deemed to have made the required certification concerning the necessity of the loan request in “good faith”. It also reminds borrowers that the SBA has previously stated that all PPP loans in excess of $2 million, and other PPP loans as appropriate, will be subject to review by SBA for compliance with program requirements set forth in the PPP Interim Final Rules and in the borrower Application Form.

This new rule makes it clear that while loans over $2 million are subject to review for the “necessity of the loan request”, any loan may be subject to a review for compliance with eligibility, loan amount, and forgiveness. Specifically, under the new 2021 IFR on loan amounts for self-employed individuals, Schedule C filers using gross income to calculate loan amounts with more than $150,000 in gross income will NOT automatically be deemed to have made the statutorily required certification concerning the necessity of the loan request in good faith. This poses an increased risk of the loans being subject to the SBA’s loan review process by the SBA to ensure the validity of the borrower’s certifications.

According to the Interim Final Rule on SBA Loan Review procedures, a lender must notify a borrower within 5 business days of receipt of such a request by the SBA. The rule also states that the SBA may reach out directly to the borrower for such requests. The SBA anticipates issuing a separate interim final rule addressing the appeals process for SBA determinations that the borrower is ineligible for a PPP loan or ineligible for the loan amount OR the loan forgiveness amount claimed by the borrower.

No. The applicant is only required to deduct cash compensation. Non-cash benefits like employer contributions to defined benefit or defined contribution retirement plans, payment for the provision of employee health benefits consisting of group health care coverage (including insurance premiums), and payment of state and local taxes assessed on compensation of employees.

Payroll costs are calculated on a gross basis without regard to (i.e., not including subtractions or additions based on) federal taxes imposed or withheld, such as the employee’s and employer’s share of Federal Insurance Contributions Act (FICA) and income taxes required to be withheld from employees. As a result, payroll costs are not reduced by taxes imposed on an employee and required to be withheld by the employer, but payroll costs do not include the employer’s share of payroll tax. For example, an employee who earned $4,000 per month in gross wages, from which $500 in federal taxes was withheld, would count as $4,000 in payroll costs. The employee would receive $3,500, and $500 would be paid to the federal government. However, the employer-side federal payroll taxes imposed on the $4,000 in wages are excluded from payroll costs.

As noted in the Loan Forgiveness Application Form, the borrower must retain PPP documentation in its files for six years after the date the loan is forgiven or repaid in full, and permit authorized representatives of the SBA, including representatives of its Office of Inspector General, to access such files upon request.

American Riviera Bank knows and cares about our customers.